Slow Demand Keeps Lumber Prices Flat

STEADY TAKE-A-WAY AMID NORMAL SEASONALLY SLOW DEMAND WAS THE NAME OF THE GAME FOR JANUARY 2024 NORTH AMERICAN CONSTRUCTION FRAMING DIMENSION SOFTWOOD LUMBER SALES.

Prices remained essentially flat, providing much-needed stability for both the forest products manufacturing industry and home builders alike. Expectations for reasonably good housing starts numbers this year are widely acknowledged.

The interest rate increases which began in mid-2022 achieved the dampening effect that was intended; new housing construction last year did indeed slow down somewhat. As spring building season comes on,

there is a likelihood of increased lumber sales and rising prices.

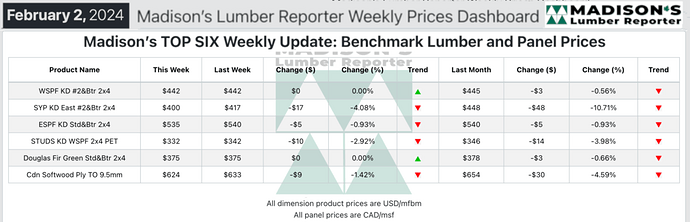

In the week ending February 2, 2024, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm, which is flat from the previous week when it was $442, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$3, or -1%, from one month ago when it was $445.

While January volumes and margins were up for many Western S-P-F traders in the United States compared to last year, this was not a busy week by any stretch. It seemed that players on both the supply and demand side were biding their time, with producers holding firm on asking prices while buyers sat on their hands waiting for the market to show a clear direction.

Order files were commonly reported in the two-week range and accumulations of prompt material were few and far between. Despite the current lull, a sense of optimism among suppliers was unmistakable, with most anticipating a strong spring building season. Time will tell.

The sluggish tone in Western S-P-F persisted this week in Canada as buyers twiddled their thumbs while producers sat on two-week order files and flat pricing.

January was an even-keeled month from stem to stern, and that balanced pace to business was present as February dawned.

Sawmills showed little to no buildup of material though inquiry and takeaway remained quiet.

Weather in many Western regions continued to steadily improve, easing the challenge of transportation.

Freight rates were stable in line with relatively unchanged fuel prices and ongoing competition among providers.