Sales Volumes of Lumber Increase as Prices Remain Even

ACTUAL SALES OF CONSTRUCTION FRAMING DIMENSION SOFTWOOD LUMBER DID IMPROVE AT THE END OF FEBRUARY, EVEN AS PRICES REMAINED FLAT.

Suppliers fielded good volumes of calls, many of which followed through to actual sales. Customers dropped their recent habits of buying only the wood absolutely needed for ongoing projects. As the first signs of spring have not yet arrived, the momentum of North American lumber sales shifted from just-in-time buying to beginning to stock up on inventory. Prices did remain essentially flat however. Expectations are that rampant sawmill curtailment will first cease, bringing manufacturing levels up closer to previous spring volumes, before prices rise significantly.

There is a good volume of wood production available to come back online as spring building season approaches.

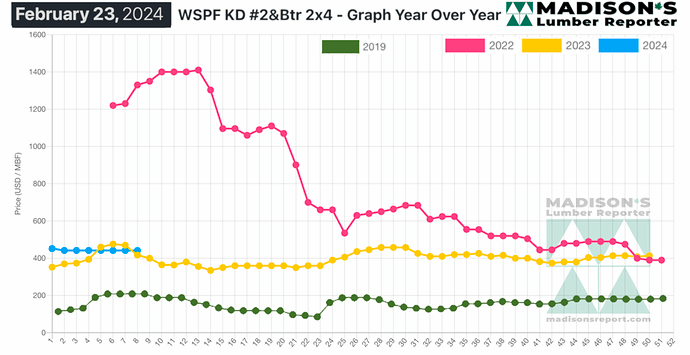

In the week ending February 23, 2024, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$442 mfbm. This is flat compared to the previous week when it was $442, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is down by -$3, or -1%, from one month ago when it was $445.

Western S-P-F purveyors in the United States noted an improving sentiment among buyers and suppliers. Demand from end-users stubbornly lacked momentum however. Discounted material was less prevalent at the sawmill level, and availability continued to dwindle. Lean field inventories were common as weak financial forecasts and waffling economic indices sapped buyers’ optimism.

While the market appeared flat on the surface, players waited with bated breath for the floodgates of sales to open. Secondary suppliers encouraged their customers to cover 2×4 and 2×6 dimension as this remained the cheapest plate stock in North America, aside from Southern Yellow Pine.

Suppliers of Western S-P-F lumber in Western Canada navigated an unclear market. Buyer sentiment changed day-to-day, from confident to sour and back again. The standoff between relatively balanced supply and demand persisted, with both sides waiting for the next litmus test moment to show a clearer direction. Sawmills maintained a cautiously optimistic tone amid firm prices and order files in the range of two weeks.

One large producer in Western Canada was apparently off the market from midweek-on. Mill curtailments and shutdowns continued to come down the pike, but players said those developments hadn’t affected the supply-demand equation much – yet.