Increased Demand Rises Some Lumber Prices Slightly

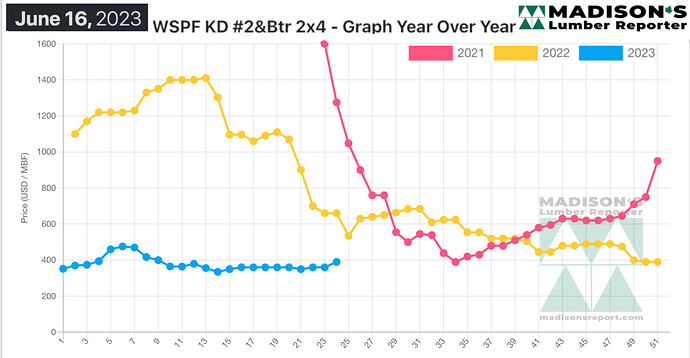

IT WAS AT THIS TIME TWO YEARS AGO THAT THE BENCHMARK LUMBER PRICE, OF WESTERN SPF 2X4S, REACHED THE ASTRONOMICAL HIGH OF US$1,600 MFBM.

This radical increase eclipsed any price level previously seen by 3X.

Mayhem ensued throughout the lumber market, for suppliers and customers alike, as industry worked to adjust to this new high.

It is important to note, however, that while that was the real price for wood at the time, there was little volume actually sold.

It is also important to note that when prices did begin to drop again, that correction down was much lower than what the price level had been before the extreme rise. This kind of stark volatility is not favoured by sawmills or wholesalers; indeed they would rather sell high volumes of lumber at a lower price.

Since mid-2022 when increasing lending rates became a reality the demand for lumber has evened out, providing industry the ability to keep prices much more level.

Thereby giving some much-needed stability to the market.

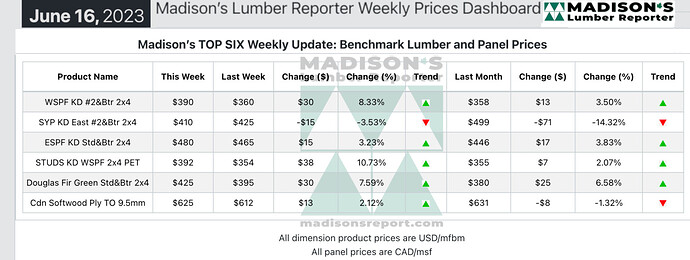

In the week ending June 16, 2023, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$390 mfbm, which is up by +$30, or +8%, from the previous week when it was $360, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$33, or +9%, from one month ago when it was $358. Some buyers shopped the same tally repeatedly throughout the week only to come away empty-handed.

Demand for Western S-P-F picked up steam according to traders in the United States. Sales of both studs and dimension surged, with studs posting the most gains in pricing. US players were adamant that the catastrophic wildfire situation in Canada was the main driver of this recent jump in business. This new burst in activity was lead by retail customers scrambling to cover supply needs for construction jobs they may have become complacent on.

With lumber Futures at a notable premium to cash in this tradable market, buyers were wringing their hands more than usual over every lost deal.

Both primary and secondary suppliers of Western S-P-F dimension lumber in Western Canada were busier than they have been in months.

It was better-late-than-never as players had thought real spring sales volumes might never arrive. With lead times pushing three weeks in some cases, purveyors urged their charges to cover more than just short-term needs.

Sawmill curtailments and wildfires helped motivate buyers to protect against future supply disruptions.

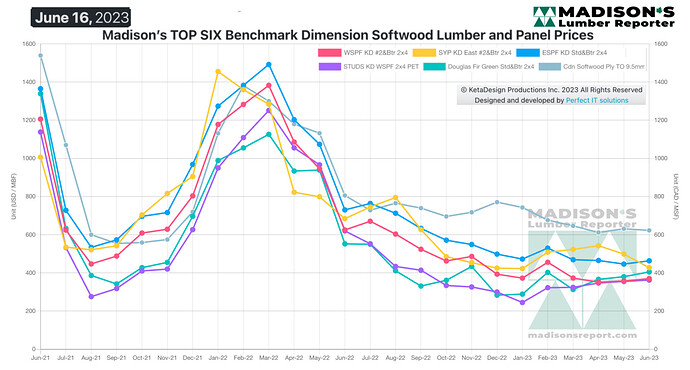

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY AVERAGES

COMPARED TO THE SAME WEEK LAST YEAR, WHEN IT WAS US$660 MFBM, THE PRICE OF WESTERN SPRUCE-PINE-FIR 2×4 #2&BTR KD (RL) FOR THE WEEK ENDING JUNE 16, 2023 WAS DOWN BY -$270, OR -41%.

COMPARED TO TWO YEARS AGO WHEN IT WAS $1,275, THAT WEEK’S PRICE IS DOWN BY -$885, OR -69%.

See the full report at: madisonsreport.com