US Housing Market May & Softwood Lumber Prices June: 2023

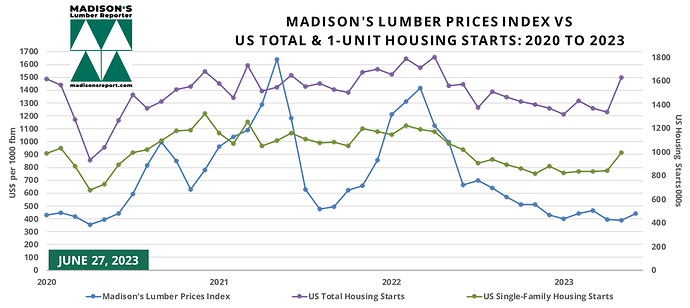

US HOUSING STARTS AND NEW HOME SALES DATA FOR MAY 2023 BOTH SHOW A TURN-A-ROUND POINT FROM THE SLOW-DOWN OF MID-2022, WHEN LENDING RATES STARTED TO RISE.

PROVIDING INDICATION THAT THE BACKLOG OF HOMES UNDER CONSTRUCTION IS EASING, HOUSING COMPLETIONS IMPROVED CONSIDERABLY OVER THE VERY HIGH NUMBERS OF THE PAST YEAR.

Total housing starts in the US for May 2023 shot up by +22% from the previous month, to 1.631 million units, compared to the 1.340 million units reported for April, and were up +6% from the May 2022 rate of 1.543 million units.

An indicator of growing construction activity to come, building permits also increased, up by more than +5%, at 1.491 million units from the April rate of 1.417 million. This is -13% below the May 2022 rate of 1.708 million. These permits will eventually become starts and will help to underpin residential construction. Still very high compared to historical, housing completions grew by +9.5% from April, rising to an estimated annual rate of 1.518 million housing units

Units under construction also remained high compared to historical averages, at 1.689 million units. Of those, 695,000 were single-family homes, compared to 699,000 in April.

May starts of single-family housing, the largest share of the market and construction method which uses the most wood, also jumped wildly, up almost +19% to a rate of 997,000 units from April’s 841,000 units.

Single-family authorizations were at 897,000 units, which is almost +5% above the April figure of 856,000 units. Building permits are generally submitted two months before the home building is begun, so this data is as indicator of July construction activity.

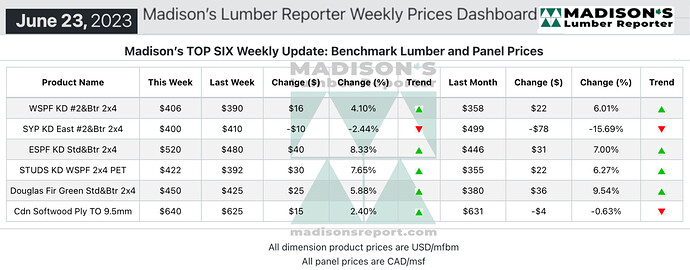

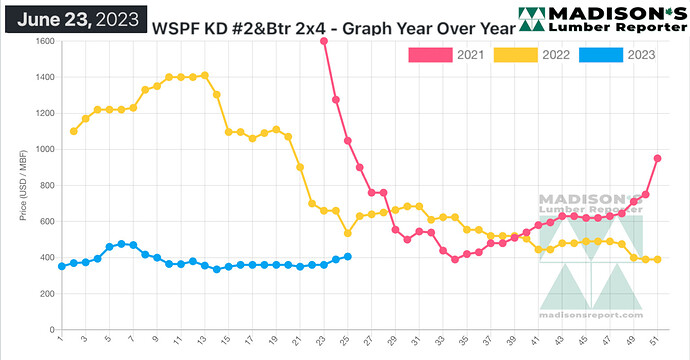

Looking at lumber prices, in the week ending June 23, 2023, the price of benchmark softwood lumber commodity Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$406 mfbm, which is up by +$16, or +4%, from the previous week when it was $390, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

That week’s price is up by +$49, or +14%, from one month ago when it was $358.

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: HISTORICAL AVERAGES

As June passed the mid-way point and questions swirled about overall supply given ongoing wildfires, demand was strong for lumber, studs, and panels. Other concerns included recent curtailments and production adjustments, as well as upcoming summer shutdowns in Eastern Canada, explained Madison’s Lumber Reporter. Demand for Western S-P-F commodities finally jumped out of the gate according to traders in the United States.

Many buyers were caught flat-footed with their inventory, resulting in a flurry of short-covering that fed this recent rally.

Sawmill offerings got slimmer and inventory that was heretofore amply available for quick shipment through the distribution network vanished with alacrity.

WSPF sawmills in the US took advantage of this rush in demand and extended their order files into mid- or late-July.

Meanwhile, for the second week in a row, suppliers of Western S-P-F lumber in Canada showed unbridled optimism in a rising market. There was a perception growing among buyers that whoever didn’t at least cover short-term needs would likely miss out, as the market appeared to be entering a sustainable rally. Sawmill lists were noticeably depleted by mid-June, and sawmill order files were into early- or mid-July.

- Madison’s Lumber Prices, weekly, are a good forecast indicator of US home builder’s current lumber buying activity ——> DETAILS

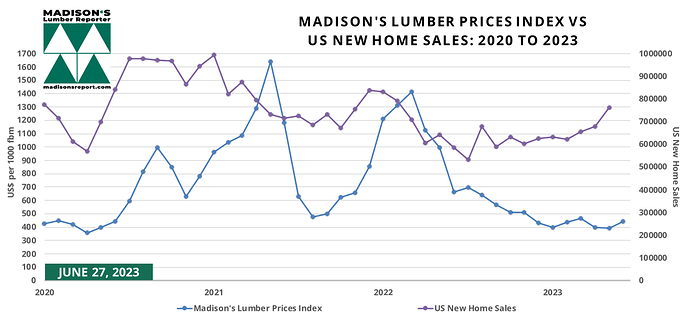

The U.S. Census Bureau and the US Department of Housing and Urban Development released June 27 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

After moderating for about a year since lending rates started rising, sales of new single-family homes in the US jumped sharply in May, at 763,000 units, which is up more than +12% from April’s 680,000.

And is a +20% increase compared to May 2022 when it was 636,000 units.

US NEW HOME SALES MAY & MADISON’S LUMBER PRICES INDEX JUNE: 2023

At the sales pace in May, it would take 6.7 months to clear the supply of new houses on the market, which is just a little bit higher than the historical average.

Correcting downward after a recent surge, the median sales price of a new home in May fell by almost -15%, to US$416,300, from US$487,300 in April, and is down -7.6% from one year ago.

As for those lumber prices, compared to the same week last year, when it was US$535 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending June 23, 2023 was down by -$129, or -24%.

Compared to two years ago when it was $1,040, that week’s price is down by -$642, or -61%.

MADISON’S WESTERN S-P-F 2×4 LUMBER PRICES: JUNE 2023

find the full report at: madisonsreport.com