By Brooks Mendell

When it comes to managing a forest or procuring wood or running a mill or analyzing a market, the “safest” and most productive posture for any professional is to understand what you’re looking at (transparency) and to know what to do as conditions change (competence). However, as with any business plan or model, we sometimes find ourselves revisiting basic ideas and conclusions with respect to how the forest industry works.

The late philosopher of science Thomas Kuhn introduced the term ‘paradigm shift’ in his 1962 book The Structure of Scientific Revolutions. While Kuhn focused the term on major changes in models and methods in the natural sciences, it has become a popular approach for framing significant shifts in our understanding of business, social norms, politics, and other fields. In forestry, as technologies continue to advance and new markets emerge, the question of paradigms feels relevant for those looking to maximize value from timberlands and wood basins.

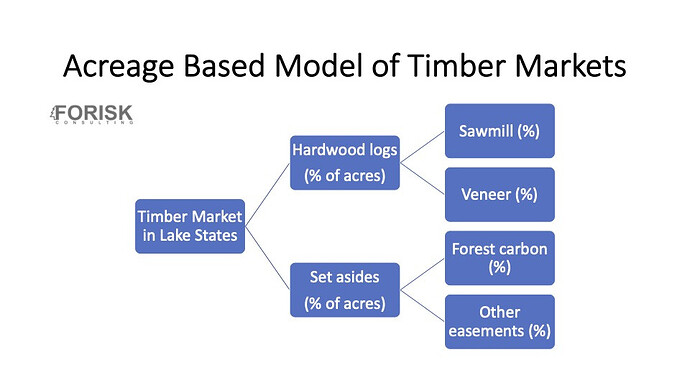

For example, with carbon markets and ESG driving investment pitches and dialogues in Board rooms, do we have a new model of forest management on the table, or do we simply have a new forest product, in forest carbon, that must compete for its “share” of the forest?

From the perspective of a timberland investor or a timber REIT or, in particular, an integrated firm that owns timberland and mills, the process for realizing value from a given timber market or wood basket is a resource allocation decision specific to the trees grown on and logs harvested from owned forests. This “fact” becomes more relevant in the context of expanding end markets for wood and forests that include CLT and Mass timber on the “traditional” end and ESG or forest carbon markets on the “emerging” end.

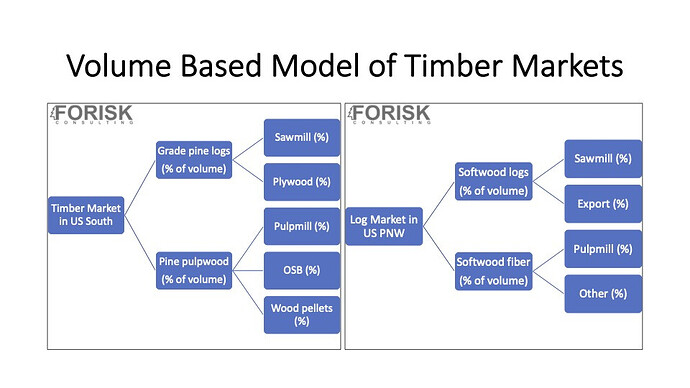

To compare how timberland owners and investors in different geographies might allocate their log resources, consider these basic models for framing timber market fundaments. For traditional timber markets, volume-based scenarios, which focus on maximizing the value of trees grown and harvested given the available local mills, can also be differentiated by specific end market or by log size.

Another way to think about these allocations would be to break up the ownership or markets by acres rather than by timber volumes: