Fueled primarily by tight supplies, upward price momentum was unabated in most framing lumber species this week.

The sales pace moderated compared to recent weeks. Some traders attributed the quieter tone to the industry’s migration to the NAWLA Traders Market in Phoenix, but others noted the annual conference’s impact was negligible. Buyers in many regions who had waited while questioning the current run’s staying power, given the time of year, stepped in to secure coverage when they could.

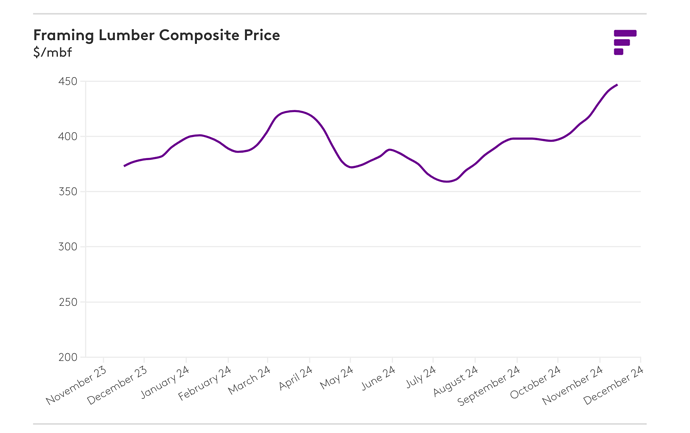

The Random Lengths Framing Lumber Composite Price gained for the seventh straight week, climbing $6 to $447. That is its highest level in more than 15 months.

Western S-P-F mills continued to command double-digit premiums for most #2&Btr dimension items. Sales slowed, due at least in part to dwindling mill offerings. Order files among many producers reached early December. The futures market drew little attention from cash traders.

Deepening discounts and mounting accumulations at many mills across the South once again ran counter to the otherwise strengthening overall trend.

Buyers moved to the sidelines or replenished sparingly, citing a traditional seasonal fade in demand and abundant supplies. Mills focused on clearing their most pressing buildups. Southern Pine sold readily as a substitute for Spruce in some northern-tier markets because of the widening price spread between the species.

In the Coast region, #2&Btr dimension prices in both Douglas Fir and Hem-Fir all increased by double digits as buyers remained active.

Green Fir sales remained stout, leading to higher prices across many items, especially in the narrow widths. 2×6 and 2×12 shared the spotlight as the hottest widths in the Inland region. 2×4 picked up the pace, but remained a step behind. MSR 2×6 was among the most difficult items to source. Shop lumber prices held steady amid a slower pace.

Source: Navigating the lumber market as prices hit a 15-month high - Fastmarkets