Since July, the National Association of Home Builders’ (NAHB)/Wells Fargo Housing Market Index (HMI), a gauge of builders’ sentiment, has dropped 22 points to its lowest level since December of last year.

November’s reading was 34, down 6 points from the prior month. The monthly average since 1985 is 52, two points higher than the demarcation between a positive outlook on home sales and a reading below 50 signaling an unfavorable outlook.

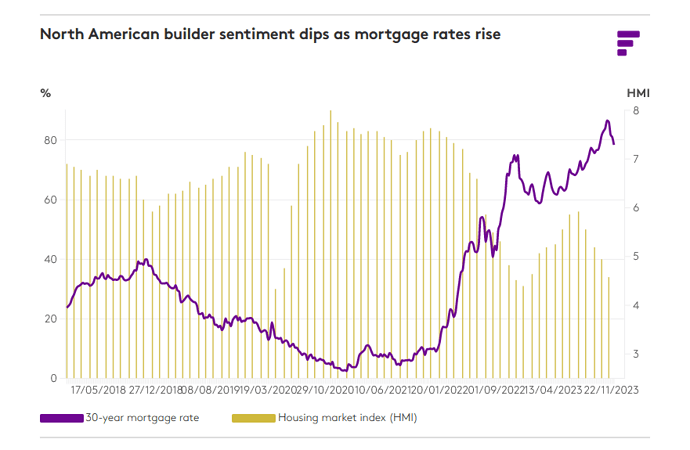

Builder opinion linked to rising mortgage rates in the US

Builders’ sentiment often falls with the rise of mortgage rates, as seen in the accompanying chart. So, it is no surprise that housing starts can also be thrown in the mix, as they adjust to builders’ perceptions as to whether homes they build can be sold profitably.

According to the NAHB, many homebuilders are now reducing the prices of recently constructed homes to increase sales. In November, 36% of builders reported cutting home prices, tying the previous high in the current cycle set last November.

All three components of the HMI declined in November. The index gauging current sales conditions dropped six points to 40. Sales expectations over the next six months fell five points, and the component measuring traffic of prospective buyers dropped five points.

However, not all is doom and gloom. Mortgage interest rates have dropped significantly in recent weeks from a high of 7.79% to 7.22%, which is likely to boost builders’ outlook on the market. Inflation has cooled, and the Fed’s rate hikes have been suspended, with some even talking about them being cut.