Paper mills at home and abroad are gobbling up America’s recycled cardboard, driving up prices for old pizza boxes and other corrugated containers that they pulp and make into new packaging.

The price of old corrugated containers, or OCC, surged during the pandemic e-commerce boom and then came crashing down in 2022 when rising interest rates prompted businesses to slow ordering and reduce inventories. Over the past year, though, OCC prices have rebounded, more than tripling in some parts of the country.

The latest rise is being driven by the opening of several new mills that need used cardboard to make fresh containerboard for corrugated shipping boxes and paperboard, which is folded into cereal boxes and coffee cups. Mills are vying for recycled boxes at a time when there are fewer available because of lower cardboard production while businesses were destocking.

“The more boxes you sell, the more boxes you get back, all else equal,” said BofA Securities analyst George Staphos.

Meanwhile, recent research suggests that Americans aren’t recycling nearly as many of their old boxes as they could, particularly at home. Spotty residential recycling means a lot of valuable material winds up in landfills instead of back at the mills.

The Red Sea conflict is adding pressure. Fighting has cut off the route that Europe’s old boxes take to mills in Asia and has sent the region’s OCC buyers looking to the U.S. for their raw material. That means more competition for recycled boxes on the West Coast, analysts say.

Producers of both containerboard and paperboard have pointed to rising input costs, including OCC, as a reason for their own recent price increases.

The national average price for OCC free on board, or at the seller’s loading dock, was $87 a short ton in January, up from $29 a ton a year ago, according to Fastmarkets RISI’s PPI Pulp & Paper Week. The trade publication surveys buyers and sellers to establish benchmark prices.

Besides transportation costs, mills are paying premiums above the benchmark price for cleaner, more carefully sorted bales of recycled cardboard, said Greg Rudder, Pulp & Paper Week managing editor. All told, the cost to mills has lately been as much as twice the benchmark, he said.

OCC prices have been highest lately at West Coast ports, where prices have risen by about one-third since December 2022, to as high as $190 a ton, according to TTOBMA, a pulp and paper consulting firm that tracks sales and prices.

In the domestic market, prices have climbed sharply in the Southeast, to around $150 a ton in some cases, which is more than three times the price mills in the region paid a year ago, said Garrett Mason, TTOBMA’s director of recovered paper.

Several of the largest new containerboard mills that have opened over the past year are in the South, including Domtar’s in Kingsport, Tenn., and Pratt Industries’ in Henderson, Ky.

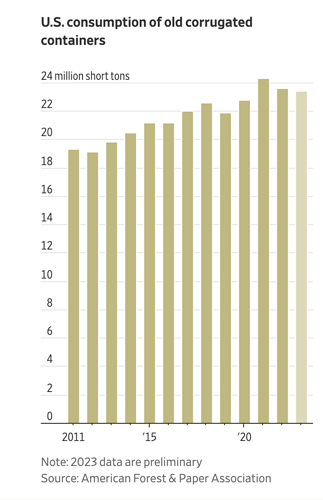

They are among the more than $7 billion of containerboard-manufacturing investments that have been announced since 2019, according to trade group American Forest & Paper Association. When the last of that batch opens next year, they will cumulatively consume more than 9 million tons of recycled fiber each year.

The added competition has mills going farther afield to find enough old cardboard for feedstock, Mason said.

“All of a sudden you’re in your competitors’ backyards trying to get their tons and having to pay more to pry that away,” he said. “We’re seeing a lot of fighting for tons and supply.”

Analysts say that prices should eventually come back down as cardboard production ramps back up.

One place mills might find more OCC is in landfills. Researchers with Circular Ventures, a consulting firm, and Bloomberg Intelligence say they have crunched the numbers and estimate that as much as 16 million tons of OCC winds up in landfills each year instead of back at mills. That works out to a recycling rate of about 69%, which is well below other industry estimates, they say.

Much of the thrown-away boxes come from homes and small businesses rather than warehouses and retailers, who are typically vigilant recyclers who are paid for their old cardboard, said Myles Cohen, a former Pratt executive who runs Circular Ventures.

“You’re not going to get much more from those big box stores or million-square-foot warehouses,” Cohen said. “It’s on the residential side and small commercial side.”

Terry Webber, vice president of industry affairs at the American Forest & Paper Association, said the discrepancy between Circular’s estimate and the trade group’s higher estimate of an effective recycling rate of between 80% and 85% has to do with how the boxes are counted that arrive in the U.S. holding imported products. Webber said the group stands by its math.

Some producers are launching initiatives to ensure their mills are well-fed. Graphic Packaging Holding is spending $1 billion to build a new recycled paperboard mill in Waco, Texas.

The location was chosen partly because of all the OCC generated in the area around the site, which includes Houston, Dallas and San Antonio, said Melanie Skijus, Graphic’s vice president of investor relations. A lot of OCC also travels past the site on its way to Mexico, she said.

The facility’s pulping equipment will be able to break down up to 15 million paper cups a day. To feed it, Graphic, which sells billions of cups annually, is working with fast-food restaurants on collecting used cups, Skijus said.

“We have more to do with education and working with communities and investing in collection capabilities,” she said.