Global trade in softwood plywood is booming, and the UK has been experiencing the greatest change in supply for years and years.

The market enjoyed its strongest month in April, with import volumes bouncing back and gaining 4.7% higher than in April last year, according to Timber Development UK (TDUK). Import volumes were around 5000 cubic metres, with Brazil leading the charge, supplying an extra 3500 cubic metres.

In response, China, Chile, Uruguay, and Canada also lifted exports to the UK, although Finland experienced a substantial fall in volume.

“Although import volumes of all wood products remain below those in 2023, it’s encouraging to see the deficit continuing to fall, with all changes in volume imports now down to single figures,” said TDUK head of technical and trade Nick Boulton. Mr Boulton said the UK’s poor overall economic performance during Q1 of 2024 and further falls in house building starts had impacted the industry.

“However, now that the UK election is over and we have a new government, the timber industry must unite and demand much-needed investment in the construction sector so we can return to growth.”

Nick Boulton, TDUK’s Head of Technical and Trade.

Indian plywood is booming despite lumber imports in decline.

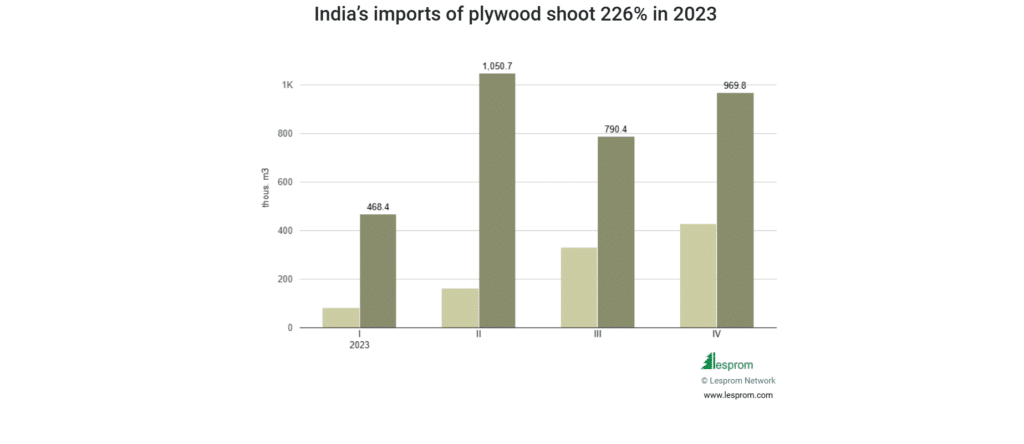

Meanwhile, Indian plywood demand, like the UK and the United States, is experiencing a surge due to the country’s booming infrastructure projects and a shift in interior design preferences—despite a freefall in total lumber imports.

India is now one of the world’s largest plywood importers, with trade rocketing last year.

Vital to construction and furniture making, India’s plywood industry is expected to hit a US $3.8 billion value by the end of 2028-29, with the market expected to grow 6.74% every year for the next five years.

According to the Federation of Timber Merchants and Sawmillers, Indian builders and furniture makers are now turning to plywood (not lumber) to fuel growth in government infrastructure projects and real estate.

With real estate expected to contribute about 13% to India’s GDP by FY25 and reach US $1 trillion by FY30, the momentum gained by the post-pandemic recovery has significantly impacted the demand for plywood.

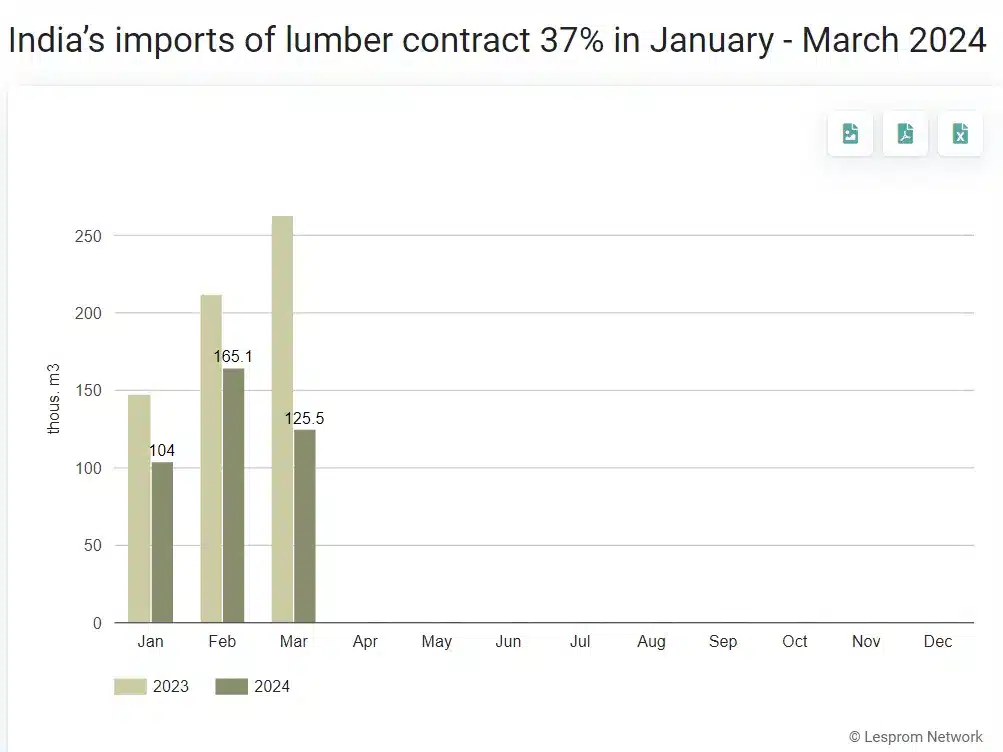

At the same time that plywood imports are booming, India has scaled back on its import of lumber.

India is part of the Big 5 for global furniture.

As it stands, India is the world’s fifth-largest furniture producer by volume and fourth-largest consumer, with plywood’s domestic consumption expected to reach $32.7 billion by 2026. This is driven by rising disposable incomes and a shift in consumer preferences to affordable yet aesthetically pleasing home decor, making ready-made furniture increasingly popular for its convenience and low maintenance.

It comes as the plywood industry has faced severe challenges during the pandemic, such as an interrupted supply chain and a decline in the construction sector. However, the industry swiftly adopted digital and e-commerce solutions for the new reality.

Like the UK and India, the United States is now flooded with plywood – with a surge in shipments now arriving at American ports from all corners of the world (Photo Credit: Maksym Yemelyanov / Alamy Stock Photo)

As a result, it has witnessed a spike in demand for furniture such as tables, laptop desks, and office chairs as working from home and hybrid work models became the norm. The industry saw a strong recovery through 2023, driven by an increase in home furnishing and the revival of the housing market.

By 2047, the world’s most populous country will need to construct around 230 million housing units to meet demand. [This year, India’s population is expected to reach 1.7 billion, with 51% living in urban regions, surpassing the population of mainland China].

After 27 years, India has removed the ban on the use of timber in the construction of buildings. The decision oy the Central Public Works Department, the prime construction agency of the central government, comes after the Union Environment Ministry asked the department to remove the ban, saying it would build jobs and create demand for eco-friendly and sustainable building practices. (Photo Credit: Mohit Singla / Alamy Stock Photo)

Increasing urbanisation significantly contributes to the demand for plywood, which is used extensively in construction and furniture making. A growing trend towards sturdy and durable construction materials, alongside a surge in home renovation projects, fuels the demand for quality plywood.

The rising demand for ready-to-move-in apartments, which typically feature extensive use of plywood in interiors, is a key growth driver. Schemes such as the Pradhan Mantri Awas Yojana—a credit-linked subsidy scheme by the Indian government to facilitate access to affordable housing—are indirectly boosting the plywood market.

There is also a marked shift in consumer preferences towards premium-quality and environmentally friendly plywood variants, emphasising aesthetics as much as functionality.

Source: Plywood Frenzy: India & UK Drive Demand to Post-Covid Heights | Wood Central