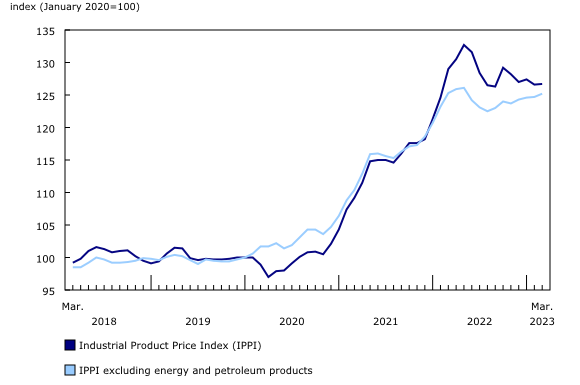

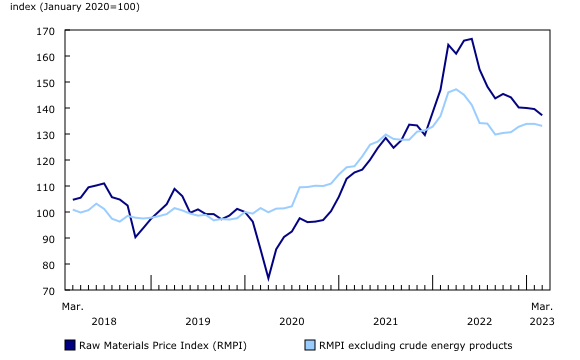

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), edged up 0.1% month over month in March and fell 1.8% year over year. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), decreased 1.7% on a monthly basis in March and were down 16.5% year over year.

Industrial Product Price Index

The IPPI edged up 0.1% month over month in March, following a 0.6% drop in February. Excluding energy and petroleum products, the IPPI was up 0.4% on a monthly basis in March, and down 0.1% year over year.

Prices for primary ferrous metal products, a category that includes steel products, rose 4.3% from February to March. Year over year, prices for this category were down 1.4% in March. Several North American steel mills raised prices in March and early April.

Prices for energy and petroleum products fell 2.7% month over month in March. The price of finished motor gasoline rose 3.6% month over month in March, while prices for diesel fell 5.1%. According to data from Natural Resources Canada, the crude oil cost component of retail gasoline and diesel fell 2.3%, from 66.6 cpl (cents per litre) in February to 65.1 cpl in March. Gasoline refining margins rose 14.9%, while refining margins for diesel decreased 7.2%.

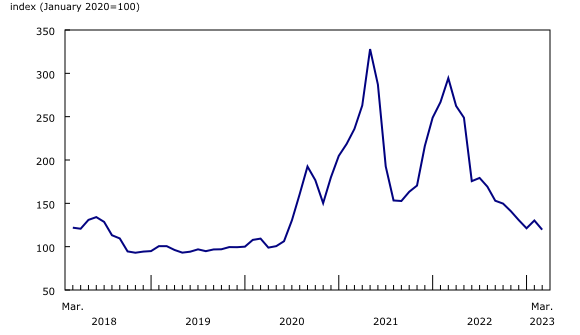

Prices for softwood lumber were down 8.1% month over month in March amidst a backdrop of increasing interest rates and a slowing residential housing market in the United States and Canada. US housing starts were down 17.2% year over year in March 2023. Year over year, prices for softwood lumber were down 59.4% in March.

In March, prices for motorized and recreational vehicles increased by 0.6% from the previous month. From February to March, the Canadian dollar depreciated 1.7% against the US dollar. As many prices in this category are reported in US dollars, the movement in the exchange rate contributed to the monthly price increase in this commodity group.

Price movements for primary non-ferrous metal products were mixed in March. The price of nickel fell 11.3% month over month in March due to strong global supply. At the same time, prices for safe-haven metals rose, including gold (+4.9%) and silver (+1.8%). Concerns stemming from bank failures in the United States and a pessimistic macroeconomic outlook both played a part in driving investors towards precious metals.

Prices for meat, fish, and dairy products (+1.1%) increased for a second straight month in March. Prices for fresh and frozen beef and veal rose by 7.4%, the largest month-over-month gain since August 2021 (+18.6%). Prices for fresh and frozen beef and veal have been rising since November 2022 and were 17.5% higher in March 2023 than in March 2022. Tightened supply and strong seasonal demand—especially demand from the US market—both played a part in the rising prices for beef.

In February, US beef cold storage dropped 6.3% from the previous month. Multiple factors were affecting the upward trend in beef and cattle prices, including rising input costs and shrinking inventories of cattle on feed. Compared with March 2022, cattle slaughter numbers in March 2023 dropped in Canada (-4.6%) and the United States (-2.0%). US live cattle futures have been generally trending upwards since April 2020. Meanwhile, prices for fresh and frozen pork declined by 2.2% month over month in March 2023. Prices were partly influenced by ample supply, with US pork cold storage up 9.0% on a yearly basis in February 2023. Canadian pork storage in the first quarter of 2023 (+1.9%) was also higher compared with the previous quarter.

Chart 1

Prices for industrial products edge up

Raw Materials Price Index

The Raw Materials Price Index decreased 1.7% month over month in March, and this is the fifth straight monthly decline. Year over year, the index declined by 16.5% in March.

Prices for crude energy products fell 3.3% in March, a fifth consecutive monthly decrease. In March, the price of conventional crude oil declined 3.4% month over month and was 28.2% lower compared with March 2022. This was the largest year-over-year decrease for conventional crude oil since November 2020 (-28.9%). Synthetic crude oil (-3.2%) also fell month over month in March 2023. Pessimism stemming from bank failures in the United States contributed to the monthly price decrease for crude oil, however as of the second week of April prices have recovered from the drop.

Prices for crop products decreased 3.9% month over month in March, with widespread decreases for commodities in the group. On a monthly basis, the price of canola fell 5.8% in March, grains (except wheat) dropped 5.2%, and wheat was down 3.5%. Global canola supply, especially supply from Australia, put downward pressure on canola prices. The extension of the Black Sea Grain Initiative which allowed Ukraine to continue to export wheat partially contributed to lower wheat prices.

Prices for animals and animal products rose 1.6% month over month in March. Prices for hogs were up 4.9%, while prices for cattle and calves increased 2.7%.

Chart 2

Softwood lumber (except tongue and groove and other edge worked lumber)

Chart 3

Prices for raw materials decrease

Source: The Daily — Industrial product and raw materials price indexes, March 2023