December 16, 2021

Author: Rajan Parajuli, PhD

Share

This is an abbreviated version of Dr. Rajan Parajuli’s article published in Volume 317 of the Journal of Cleaner Production on October 1, 2021. The full article is available here or, if you don’t have access to this particular article, contact the author at: rparaju@ncsu.edu for a PDF copy of the full article.

The European Union recently revised their aggressive renewable energy policy targets—Recast to 2030 (RED II), which states that by 2030, European countries plan to increase the use of renewable energy to at least 32% of final energy consumption in order to cut at least 40% of their GHG emissions (EC, 2019).

In the last decade, several large-scale wood pellet production facilities have been established and are constantly producing wood pellet in the southeastern coastal region in order to meet the growing demand from the United Kingdom and European countries. About 98% of the U.S. wood pellet exports are from Southern states, which have been exponentially rising in the last few years. In 2020, the U.S. exported over 7.2 million metric tons of wood pellets to overseas markets, which was about three-times higher than the exports in 2012 (GATS, 2020).

By estimating empirical roundwood pulpwood market models based on the actual bi-monthly market data, this study evaluates the impacts of wood pellet on the pulpwood stumpage prices in Coastal micro-markets in the five southeastern states. Moreover, as the COVID-19 Pandemic continued to distort the markets and economy across the board beginning from the early 2020, this study also examines the impacts of the Pandemic on the roundwood pulpwood markets in the U.S. South. As the wood pellet industry continues to expand its market share in the timber resource markets, this study provides important insights on small roundwood market dynamics, and sheds light on prospects of wood-based bioenergy markets in the southeastern states.

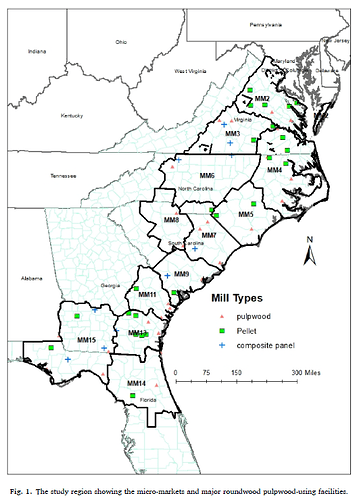

Since timber markets are local in nature, this study incorporates 12 micro-markets (MMs) covering the coastal plains of Virginia (VA), North Carolina (NC), South Carolina (SC), Georgia (GA), and Florida (FL), where most industrial wood pellet production facilities are concentrated. Fig. 1 depicts the boundaries of each MM, which are defined and tracked periodically by Forest2Market. These MMs follow county borderlines but not the state. Fig. 1 also shows the locations of major pulp and paper mills as well as pellet mills that compete for similar woody biomass feedstock in these micro-markets.

Snapshot of Conclusions

Results suggest that the wood pellet industry has driven pine pulpwood prices up in the study region. Similarly, the binary variable representing the structural break (D2012) also suggested that pine pulpwood prices in most of the micro-markets are up 5%–12% in the last several years. Compared to the past projection studies, these estimated numbers based on the actual market data are in the lower ranges of simulated price impacts of bioenergy demand in the southeastern U.S. Under the several EU bioenergy and wood pellet demand scenarios, it was projected that, by 2020, the pine pulpwood price would go up about 40% southwide (Abt and Abt, 2013), up approximately 10–40% in the southeastern U.S. (Rafal et al., 2013), and up about 90% in the southeastern coastal region (Abt et al., 2014).

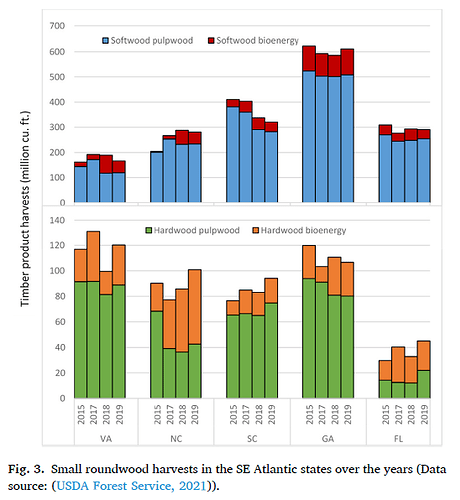

In contrast to the findings of Abt et al. (2014) which projected about a 30% increase in hardwood pulpwood prices by 2020, the wood pellet industry is found to have no statistically significant impact on hardwood pulpwood prices. The current utilization trend of hardwood resources in this region helps explain the result of no price impact of wood pellet on hardwood markets. While roundwood hardwood utilized by bioenergy mills has increased in each state (USDA Forest Service, 2021), hardwood is still about one-fourth of the total feedstock for wood pellet mills.

While the demand for pulp-based products including personal hygiene products and packaging materials skyrocketed in the first few months of the COVID-19 Pandemic, the overall impact of the Pandemic is negative in both pine and hardwood pulpwood markets. The short-term surge in the demand of pulp-based products was primarily from panic-purchases and consumer hoarding during the lockdowns. The labor shortage throughout the supply chain exacerbated by the Pandemic restrictions and lockdowns resulted in a decline in harvest and logging operations, which eventually impacted the timber prices negatively.

While the current use of roundwood pulpwood for wood pellet production is relatively low (Fig. 3), it can be expected that low-valued harvesting timber and sawmill residues would not be sufficient to meet the higher demand. On the other hand, although logging residues are reportedly abundant and underutilized all across the U.S. South (Pokharel et al., 2019), more than half of those biomass residues may not be accessible to the markets when accounting for the landowners’ willingness to supply (Swinton et al., 2020).

Similarly, several policy measures could be effective to encourage landowner’s preferences for promoting wood-based bioenergy in the U.S. South (G.C. and Mehmood, 2010). Last but not least, bioenergy from wood chips is found the least expensive and the least greenhouse gas-intensive with the lowest abatement cost among nine agriculture and forestry feedstocks (Masum et al., 2020), which highlighted the relevance and better prospects of woody biomass to substitute coal at the power plant. Based on these arguments, it can be inferred that the wood pellet industry is expected to have even bigger impacts in the foreseeable future.

Rajan Parajuli, PhD is an Assistant Professor of forest economics and policy in the Department of Forestry and Environmental Resources at North Carolina State University.