Wood Chip Exports From Brazil and Uruguay Hit Record Levels

July 11, 2022

Author: Håkan Ekström

Eucalyptus plantations in Latin America are a significant supply source to pulpmills in China and Japan. However, the Latin American share of total Asian import volumes has declined over the past five years because of the increased availability of plantation fiber in Southeast Asia (predominantly from Vietnam) and higher fiber demand from local pulpmills in Latin America.

As a result, total export volumes from the continent have steadily declined since 2018, when a record high of 4.6 million odmt was reached. Over the past decade, Chile has been the most significant exporter in Latin America. However, the country reduced shipments in 2021, while Brazil and Uruguay increased their shares of the continent’s wood chip supply for overseas markets.

In 1Q22, shipments from all three exporting countries—Brazil, Chile, and Uruguay—were up QoQ, with the total volume reaching a two-year high of close to one million odmt, reports the Wood Resource Quarterly. Both Brazil and Uruguay were close to record highs, while Chile shipped substantially less than its quarterly average volume for the past ten years. Despite increased shipments from Chile in 1Q22, the total volume exported was the second lowest in almost a decade. Practically all exports over the past decade have been to China and Japan, the latter historically having been the largest market. However, over the past few years, China-bound shipments have grown from 27% of total exports in 2018 to 53% in 1Q22.

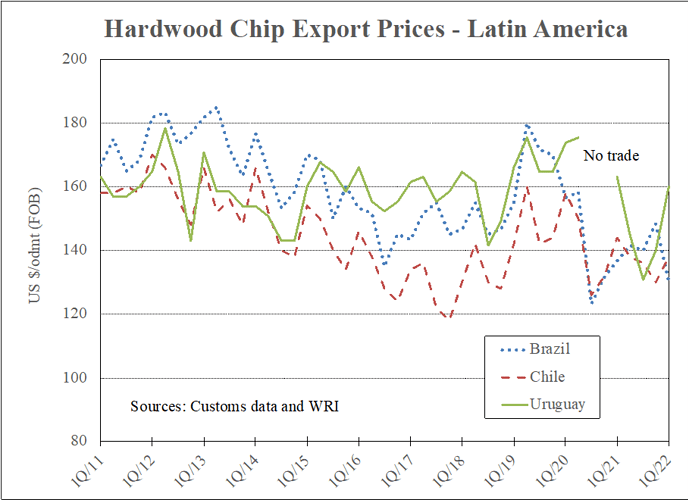

Over time, Latin American hardwood chip export prices have fluctuated depending on prices for market pulp (HBK) and the tightness in woodchip supply in the Pacific Rim region. Prices peaked in early 2019 when wood fiber demand in China and Japan was high and wood chip supply from Australia and South Africa was tightening. However, since their high three years ago, prices have trended downward and averaged $135/odmt (FOB) in 1Q22 for wood chips shipped to Asia. This level was below their 10-year average. In early 2022, export prices in Uruguay were about $25/odmt higher than in Brazil and Chile.