As we near the end of 2024, it’s time to reflect on the insightful predictions made by ResourceWise’s CEO, Pete Stewart, and Chief Revenue Officer, Matt Elhardt, for the forest products industry in 2024. Let’s take a moment to revisit these predictions and examine how they unfolded throughout the previous year.

1. The inventory destocking that occurred in virtually every industry in 2023 is coming to an end.

In 2023, inventory destocking played a significant role in shaping the sector. Destocking occurred as supply chains normalized in a post-COVID world. About halfway through the year, inventory levels across various segments normalized, with uncoated and coated freesheet supplies reduced to approximately 30-40 days—down significantly from the elevated levels seen during the pandemic. This shift reflected concerted efforts by mills and suppliers to align production with current demand, supported by strategic mill downtime to manage oversupply.

Similarly, both softwood and hardwood pulp inventories fell over the year. In the case of hardwood, days of inventory fell from about 60 days to about 40.

Since destocking appears as “lower demand” for producers, the result was lower operating rates in many sectors. This was true even in the backdrop of more normalized end demand.

As inventories returned to normal, demand began to increase in some sectors, specifically those where supply shuts brought supply into balance. For example, US containerboard producers implemented several price increases in 2024, with additional increases announced as of this writing.

2. Most new forestry investments in 2024 will be concentrated in the US South.

Forestry investments in the US South have seen notable activity in 2024, signaling the region’s continued significance in timberland markets. For example, Manulife finalized two major property sales in Alabama as part of a three-property offering.

The Clairmont Springs tract, encompassing 33,700 acres, was sold to Southern Pine Plantations for $77.5 million. The Magnolia property, totaling 13,400 acres, was acquired by Weyerhaeuser for $46 million.

Other investments included:

-

New Forests expanded its US portfolio with the acquisition of a 90,791-acre forestry estate in Oklahoma from Rayonier, marking its first investment in the US South. New Forests said the acquired asset, located near large sawmills and pulp and paper mills provides a foundation for timber sales.

-

Weyerhaeuser announced it is investing $500 million to build a new facility in south Arkansas. Once completed, the facility will process about 10 million cubic feet of wood products.

-

PotlatchDeltic continues its momentum with the announcement of a $31 million acquisition of 16,000 acres in Arkansas, alongside its pending sale of 34,000 acres in Arkansas and Alabama to Forest Investment Associates for $58 million.

Collectively, these transactions highlight the growing scale of forestry activity in the South, attracting both domestic and international investors. Such investments reinforce the region’s reputation as a key hub for forestry operations while underscoring its strategic importance for sustainable timber production and long-term portfolio growth.

3. Housing starts will be relatively strong in 2024, hanging between 1.3–1.5 mm starts.

According to SilvaStat360, total US housing starts from January to October reached 1.35 million, aligning with what was projected earlier in the year. However, 2024 saw mixed trends in housing starts, influenced by economic factors like higher interest rates. The increased rates affected both builders’ strategies and buyers’ purchasing power.

While the pace of new construction slowed slightly compared to 2023, a growing focus on energy-efficient homes highlighted shifting buyer preferences. The new home market also expanded as an alternative to the limited supply of existing homes, with builders offering incentives such as mortgage rate buydowns to attract buyers.

Despite ongoing challenges like rising costs and zoning restrictions, the demand for sustainable and modern homes remained a key driver in shaping the construction industry in 2024.

4. Increase in investment in bio-economy production at pulp mills.

Investment in bio-economy production at pulp mills is emerging as an increasingly prominent trend in the industry. The change presents a number of opportunities for both producers and the environment.

This shift towards bio-economy production is driven by the desire to reduce reliance on non-renewable resources and mitigate the environmental impact of traditional manufacturing processes. By utilizing sustainable and renewable feedstock, pulp producers can not only contribute to a greener future but also tap into new revenue streams to enhance their market competitiveness.

Investing in bio-economy production presents economic advantages as well. By leveraging technological advancements and process optimization, pulp producers can improve efficiency, reduce costs, and enhance overall profitability. Furthermore, government incentives and regulations that support sustainable practices further boost the business case for bio-economy investment.

In 2024, we saw an uptick in investments in bio-economy production in the industry. For example, Veolia, in partnership with Metsä Fibre, launched a €50 million biorefinery project at the Äänekoski pulp mill in Finland. This facility produces CO2-neutral biomethanol derived from pulp mill byproducts like black liquor.

Set to begin operations in 2024, the plant will produce 12,000 tons of biomethanol annually, preventing up to 30,000 tons of CO2 emissions. This approach aligns with global decarbonization goals and could be replicated in about 80% of pulp mills worldwide.

Nextgreen Global Bhd is also focusing on advancing innovative solutions to redefine sustainability in manufacturing. A key pillar of this initiative is the fertilizer segment, operated by its wholly owned subsidiary Nextgreen Fertilizer Sdn Bhd (NGF).

The firm is also producing liquid fertilizer by transforming black liquor into a cutting-edge liquid fertilizer product. This innovative process, spearheaded by the R&D team, is projected to yield 30,000 TPY of liquid fertilizer.

In the US, several pulp mills announced projects related to carbon capture, hoping to take advantage of market demand for lower-carbon products. For instance, the SLB and Aker Carbon Capture Joint Venture secured a contract from its partner CO2028 Solutions for front-end engineering and design (FEED) of a large-scale carbon capture plant at a pulp and paper mill on the US Gulf Coast. The project aims to remove 800,000 TPY of carbon emissions while also delivering verifiable and affordable carbon dioxide removals (CDRs).

As the industry continues to recognize the potential of bio-economy production, it offers an exciting avenue for pulp producers to directly address environmental concerns. Doing so will also unlock new revenue streams, drive innovation, and contribute to a more sustainable future. The changes are especially important as new low-carbon fuel mandates, most notably sustainable aviation fuel, begin implementing in 2025.

5. Global operating rates in the pulp and paper industry will continue to improve, bringing stability to the sector.

In 2024, the pulp and paper industry experienced a notable recovery following a challenging period of low demand and high costs in prior years. This improvement was driven by a better balance between supply and demand, supported by stabilized inventory levels and a global resurgence in economic activity.

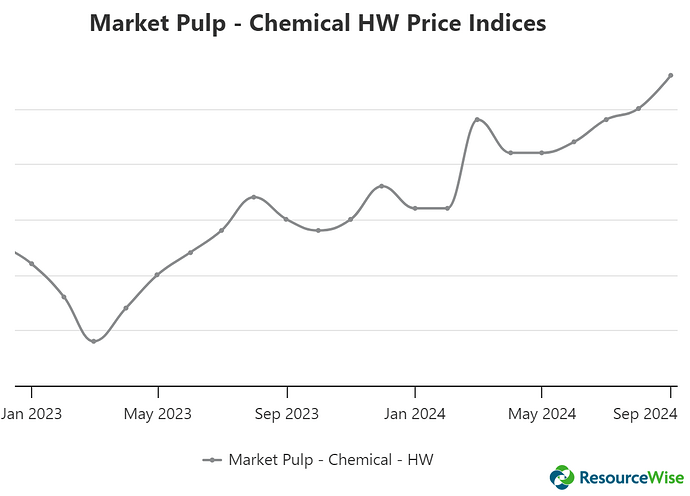

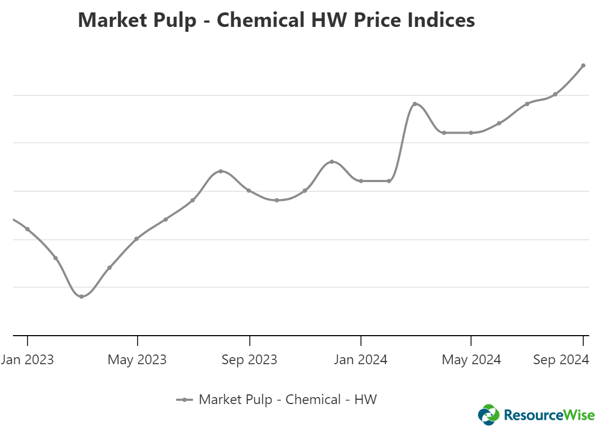

As illustrated in the graph below, hardwood market pulp prices in the US saw a significant rise in 2024 compared to 2023.

Source: ForestStat Global

Source: ForestStat Global

While higher prices don’t always directly reflect increased operating rates, they often signal growing demand for pulp and paper products. This demand, in turn, encourages greater production and more efficient utilization of manufacturing capacity.

When market pulp prices experience an upward trend, it reflects a healthier market condition where supply and demand are more balanced. This rise can be attributed to factors such as stabilized inventory levels, improved economic activity, and better alignment between supply and demand.

As market pulp prices continue to increase, the shift provides stability to the sector. In turn, this stability then fosters broader confidence in the industry.

Source: Reviewing ResourceWise's 2024 Forest Products Industry Predictions