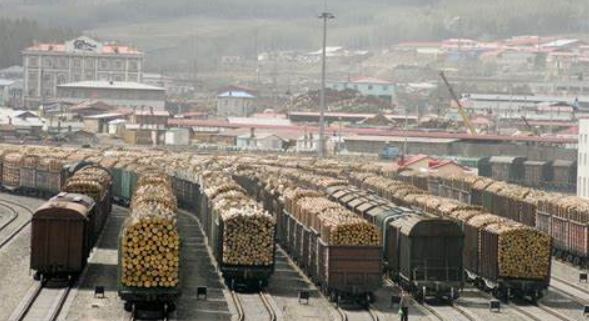

According to data from the Integrated Forestry Information System (IFIS) provided by Roslesinforg, Russia’s state forest accounting and management organisation, in the first half of 2023, Russia supplied 10 million m3 of export timber to 48 countries. Of this, sawn timber exports to China have exceeded 6 million cubic metres, up 6.3% compared to 6.121 million m3 in the same period last year. Logs, on the other hand, fell 32.2 per cent to 956,000 m3. The Russian timber industry is rapidly re-targeting its exports to China.

China’s imports of Russian timber basically the same as the same period last year

- Softwood timber imports grow significantly

China’s customs recorded timber species, the first half of the import of Russian timber is basically the same as the same period last year, year-on-year -0.89% to 7.465 million m3, imports amounted to 10.28 billion yuan. Among them, logs showed an overall decline, sawn timber overall upward trend, this trend is also in line with the ban on log exports from January 1, 2022, which came into force in Russia. However, from the point of view of the import situation of a single species, the import quantity of some wood species has changed a lot, and the import quantity of softwood has increased significantly.

The most obvious rise in volume was for oak sawn timber, up 34.31% from 47,697m3 in the first half of 2022 to 64,061m3 in the first half of 2023, while the most obvious decline in volume was for ash sawn timber, down 42.94% from 57,098m3 in the same period last year to 32,582m3. At the same time, the import volume of fir and spruce sawn timber, an increase of 16.46% to 2.812 million m3. Red pine and camphor pine were flat, -0.01% year-on-year to 2.3 million m3; other species with more growth were birch sawn timber, up 23.97% to 347,000 m3; and other pine sawn timber, up 22.99% to 98,700 m3.

- Regional exports to China grow

As far as lumber species are concerned, the growth in imported Russian oak has been helped by the contraction of oak exports from other European countries, which has led to a significant increase in Russian oak exports to China. And pine lumber growth to China is continuing and steady development, in 2023 may break through the export data of previous years. Russia’s northern timber exports to China have grown, but not as significantly as in the west-central and southeastern regions of Siberia. Among them, Yugra’s timber exports to China in January-May this year have amounted to 84,800m3, far exceeding the 58,600m³ in the same period last year, an increase of 44.7%. Vologda region’s timber exports to China in January-May even increased by 129.4%, from 167,000m3 in the same period last year to 383,100m³. The western Tomsk region, which is farther away from China, has also increased its output to the Chinese market this year, with China accounting for 27% of the 482,300m³ of timber exported, or about 130,000m3. The export of 2,100m3 of birch logs to China was also increased.

These data are also visualized in the export figures of wood companies. Sudoma, a large export-oriented wood company located in the Pskov region, which previously had an export structure of 30% for the Middle East and South-East Asia and 70% for the European market, now, after repositioning its timber sales and logistic layout, has made Asia and the Middle East its most important markets.

With Russia’s turn to China’s timber market, for the domestic market demand for pine lumber is currently weak, imported pine lumber or will not have a price advantage. And Russian imported hardwoods driven by China’s demand and global hardwood trade contraction or will maintain more growth.