The EU has cut off shipments of lumber from Russia and Belarus. The cut-off date for entry is July 10th ( see David Stallcop’s post ). Effective July 27th the USA will increase the column 2 rates of duty

( lumber products ) to 35% on Russian imports. Based on a cost of $400/ m3 in St Petersburg, Russia, the import duty would be approximately $6300 per container ( approx 30,000 bf ).

Thank you @David_Bagdy so it’s not a full ban on Russian products then? Instead, a very high tariff. Couple questions to clarify:

- No analogous tariffs of Belorus products? It’s solely Russian Federation?

- How does the resulting import duty of $6300 per container ( approx 30,000 bf ), based on a cost of $400/m3, compare with competing product imports into the US?

If you could give a brief comparison that would be helpful …

Additionally @David_Bagdy there could be a valuable poll on the competitiveness/willingness to buy Russian pine at the currently prices w/ these import tariffs that we could run next week. Let us know and we can connect offline!

@David_Stallcop given you’re currently on travel in Eastern and Western Europe, what have you been seeing/hearing from the lumber industry players there, regarding Russian and Belorus wood products? Have they still been importing them until today (July 8) and racing to get as many through customs as possible until the cutoff date of July 10th, or there has been a voluntary unwillingness to buy much earlier with the war in Ukraine, and this ruling/cut off date is more of a formality?

@Andrey_Tikhomirov what have you been experiencing?

@Nadia the wood fiber was definitely still coming in through this week, but ended with a trickle. It’s over now and everyone needs to start planning for when this existing wood pile is processed through everyone’s inventory and production. September onward will be quite interesting to see where the wood will come from. Most likely from new production that is coming online out of Finland. But, will it be enough?

@David_Bagdy wanted me to post this (due to some technical issues on his side).

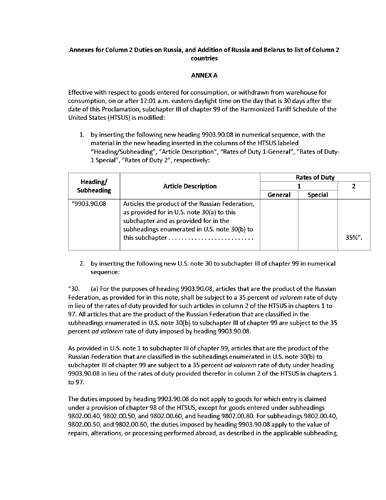

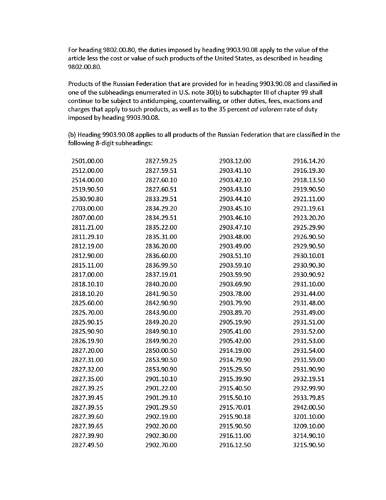

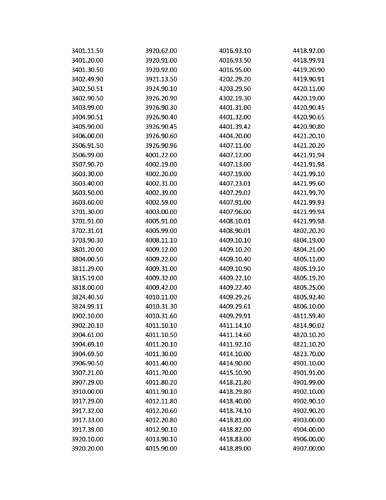

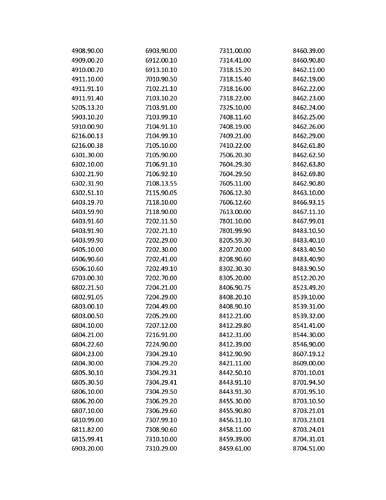

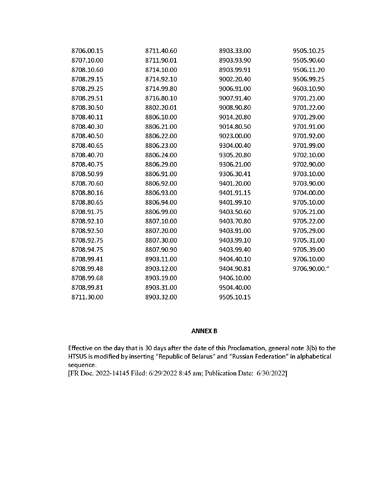

I’ve attached a copy of the bill signed June, 27th that will increase the tariffs on most products imported from Russia. Yes, Belarus is included. Scrolling through this bill there is a list of the tariff codes that will be affected. Codes starting with 4407 refer to wood products. This increase goes into effect July 27th. It calls for a 35% tariff “ad valorem”. The tariff will be calculated on the value of goods entering the States. Originally I was calculating the tariff based on the cost of goods before freight.

Let’s take a look at the numbers. Random Lengths, June 8th, reported Euro Spruce 1x4 at $1330. 1 -truck load = 28,500 board feet. A container of lumber is equal to 1 truck load. If I sell a customer in the US from one of my mills in Russia a container of Russian Spruce ( or Pine ) 1x4 @ $1330 the total invoice would be 28,500 board feet x $1330 = $37,905. Before an import enters the US a copy of the invoice and bill of lading goes to US Customs for clearance. In this case: $37,905 ( declared customs value ) x 35% resulting in a tariff/ duty of $13,266.75 ( or $465.5/ thousand board feet ). On the surface, this makes Russian Lumber cost-prohibitive.

A customer will not absorb this. Most will not pay more for Russian Spruce than they do for the same product from Germany, Austria or Scandanavia. An importer will not absorb the tariff. It destroys their profit margin. A Russian mill, however, may absorb it. Let’s look at some rough #'s. We go back to a sale of 1x4 Russian Spruce @ $1330 delivered USA, $37,905. We have freight from St Petersburg, Russia to the US $13,000. $37,965 - $13,000= $24,965; $24,965 - (tariff) $13,266.75=$11,698.25 or $410/ thousand board ft. If a Russian mill is willing to sell 1x4 Spruce at $410/ thousand board ft St Petersburg, Russia, they can absorb the tariff.

Russia has been known to subsidize its manufacturing sector and this may happen here. Will Russia move towards a command economy? These are interesting times. Call or write anytime.

@David_Bagdy please confirm everything was posted accurately as you instructed.

Importers of lumber into USA & Canada, from whichever country, did you have this analysis already setup? Would be great to get some feedback to @David_Bagdy: @Matt_Layman @Michael_Haas

@Andrey_Tikhomirov do you think Russian Mills can absorb the cost differential vis subsidies?

Man, lumber has gotten complicated and this conversation does not even include China, who is waging capital war on the world. What China will pay for lumber is what Russia will get.

Canada has lost its King of the Hill lumber status by forsaking its US relationship for China 5-10 years ago. U.S. is making lumber for itself; does not need exports. China will do to Russia what it did to Canada. Will China be the next owners of U.S. and Russian lumber industries? Better keep an eye on who owns the American timberlands. 80% privately held. Easy pickings for funds or Oligarchs. No trees, no lumber.

Seems to me there are four producing markets. U.S., Canada, Russia, Greater Europe.There is plenty of wood to go around with China the jumping bean. Remember the Great Lumber Shuffle?

Lumber and timber has become an international political pawn, which is off limits conversation inside our industry, unless properly aligned. It’s like swapping spies; same product circulating to same areas.

omg @Matt_Layman this is quite a historical, realtime, and futuristic perspective you outlined here – way beyond the impact of this latest US tariff bill on Russian and Belorus products. A macro economic perspective. Lumber/Timber has certainly entered the political and economic circles as a power grab, and pulling international strings at a minimum. Now I see how you position the plays.

Would be great to get your perspectives on Matt’s analyis: @Andrey_Tikhomirov @David_Bagdy @Manny_Schellenberg @Thomas_Mende @Arno_Wu …

The Russian mills in Siberia and those currently producing for China will continue to do so. The mills that are in Northwest Russia, which are cutting for the states, will have a difficult time switching production to the Chinese specifications. There are already policy changes taking place in Russia. They include a $0.00 cost for raw material for mills employing a given number of employees, government labor subsidies, and tariff/ tax rebates. The weakening ruble and declining transportation costs work in the mill’s favor. Short term, the volume of finished lumber from Russia to the US will decline but it’s not going away. How this plays out on the global stage is anyone’s guess. It will be September/ October before we get a feel for where we are going.

Sep/Oct seem to be the magic months in forecast these days …

-

To figure out what multifamily builders do (w/ high interest rates on mortgages and high inflation) and how that affects the wood industry prices.

-

To figure out how Russian/Belorus lumber fares in the US – maybe opens other avenues in the world besides Europe and China? Africa? SE Asia

-

My favorite hopeful forecast would be to end this criminal war in Ukraine. If that happens (hopefully!!!) some supply chain flows and prices will shift.

All great points!!

Hello!

It took me a long time to write an answer to this thread.

Indeed, the forest industry of the North-West of Russia has come to quite difficult times. On the one hand, this is the loss of the main sales markets (European and American), on the other hand, the remoteness from the Chinese market is very far, the strong ruble is pressing from above, and manufacturers from Belarus are pushing from below with their cheaper products.

As for @David_Bagdy’s calculation, I can say that as soon as the ruble weakens to the level of February 2022, then I can say that sawmills will be able to offer market prices for the American market. At the moment, there is a slow but steady decline in prices for sawn timber and roundwood. Although many small sawmills have bought sawlogs at a high price and they refuse to make the price of lumber lower because they do not want to sell at a loss, large producers who have long-term leases on large plots of forest can afford to give a good discount on their products and have a good profit.

Of course, I’m not an expert and I don’t have much experience in the timber industry, but as they say in Russia: Поживем - увидим!

Thank you @Andrey_Tikhomirov very interesting and important to hear what you are seeing on the ground and your perspective. It definitely agrees w/ that of @David_Bagdy – so maybe you guys should connect?!

We will wait and see; Поживем - увидим!

I do pray for this horrific war in Ukraine to end every day. That would turn things around more securely that some of the other factors, all of which had been caused by this war.

Thank you, Nadia. Andrey and I are connected on LinkedIn. I’ll reach out to him. We can collaborate to give a joint perspective.