While nationwide single-family housing starts have slowed in the past year, the largest drop on a percentage basis is occurring in the densest counties, due to high housing costs. Meanwhile, multifamily growth was robust throughout much of the nation at the end of 2022, with the notable exception in high-density markets, according to the latest findings from the National Association of Home Builders (NAHB) Home Building Geography Index (HBGI) for the fourth quarter of 2022.

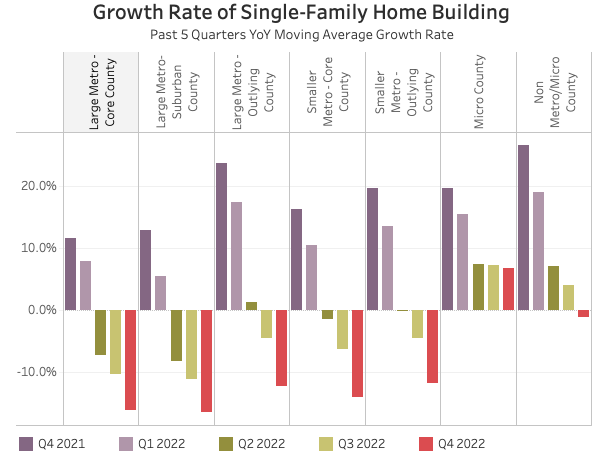

Across the single-family market, the 4-quarter moving average of the year-over-year growth rate has fallen considerably from the fourth quarter of 2021. The largest decrease in the growth rate was in Large Metro – Outlying Counites which fell from 23.6% in the fourth quarter of 2021 to -12.1% in the fourth quarter of 2022. All markets had a positive growth rate in the fourth quarter of 2021 but only Micro Counites remained positive in the fourth quarter of 2022 at 6.8%.

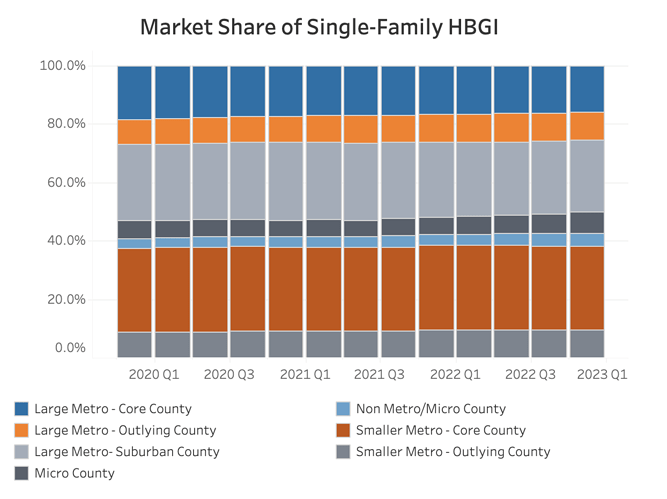

The market share in the single-family market has consistently been changing since the pandemic. As many families move out of densely populated urban centers, there has been more single-family building in outlying areas of metros, small metros, and non-metro areas. The largest increase in market share since the fourth quarter of 2019 was in Micro Counties, where the share increased from 6.0% to 7.4% in the fourth quarter of 2022. The largest decrease in single-family market share was in Large Metro – Core Counties, which fell 2.4 percentage points from 18.4% to 16.0%.

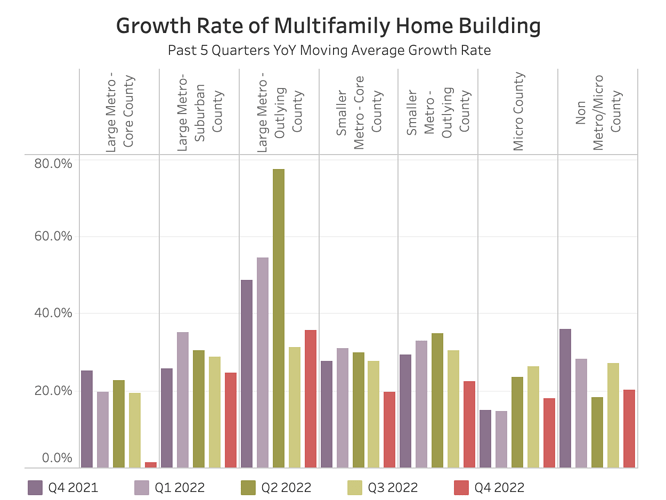

Meanwhile, the multifamily construction market remains elevated above historical levels, with six of the seven submarkets experiencing growth rates above 15.0% during the final quarter of 2022. However, Large Metro – Core Counties were an outlier and registered the smallest growth rate, up only 1.5% for the fourth quarter of 2022. Large Metro – Outlying Counties continued to have the highest growth rate for the 6th consecutive quarter at 35.7%.

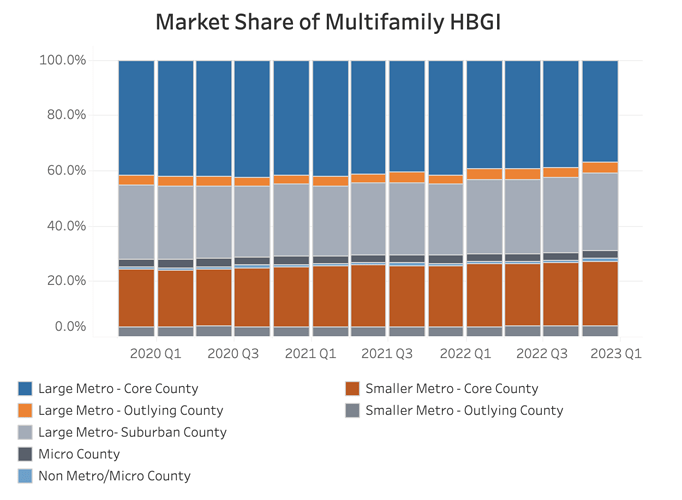

The multifamily market has shown a similar trend to that of the single-family market. The Large Metro – Core Counties market continues to have the largest market share but has fallen significantly since the fourth quarter of 2019. The market share has fallen 5 percentage points for Large Metro – Core Counites, from 41.7% in the fourth quarter of 2019 to 36.7% in the fourth quarter of 2022. All other markets experienced increases in their market shares, the largest increase was in Small Metro – Core Counties, which increased from 20.8% to 23.4% across the same period.

Source: Single-Family Market Share Continues to Shift from Large Population Centers | Eye On Housing