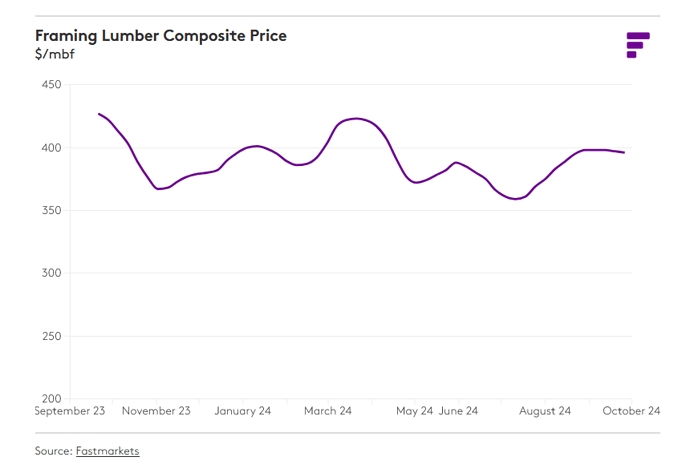

The softwood lumber market’s reaction to last week’s encouraging economic news remained moderate at best. Demand was steady in most species, but news of reduced interest rates fell far short of jump-starting sales. As a whole, prices wavered and the Random Lengths Framing Lumber Composite Price dropped $1 for the second consecutive week.

Western S-P-F sales were unspectacular. Buyers covered needs but were unmoved to procure additional supplies despite a string of positive economic news and curtailment announcements. Buyers hunted for perceived deals, but most prices were unchanged from last week’s reported levels.

Lumber futures surged early in the week, but the board gave back on Wednesday. The front month continued to carry a premium to the physical market, affording some traders basis opportunities. Hurricane Helene’s approach through the Gulf of Mexico interrupted an otherwise steady Southern Pine market. Buyers covered mostly immediate needs in early trading and scaled back new orders as the week progressed.

Production in parts of Florida and Georgia was idle by Thursday afternoon as the storm approached, with landfall anticipated late Thursday night or early Friday morning.

A perception that recent curtailments across the South had aligned supplies more closely with demand infused a firmer tone into the market. Mills raised prices steadily, but many declined to push aggressively, opting instead for a more conservative approach to sustain sales. An imminent longshoremen strike that would impact East Coast and Gulf ports was an ongoing distraction.

In the Coast region, recent trends remained in place. Demand for 2×4 ebbed, and discounts cropped up, with the cuts strongest in green Douglas Fir. The price leader in green and dry Coast species remained #2&Btr 2×12, and double-digit increases were posted again.