Strategic Pathways Through Market Disruptions in the Forest Products Industry

In the dynamic world of supply chains, disruptions are not just probable—they’re inevitable. Yet when disruptions strike, they often leave companies scrambling to assess impacts and strategize quickly. For those in the forest products industry, understanding and preparing for these disruptions is crucial.

Market Disruptions Seen in 2024

The year 2024 has been tumultuous for various markets and supply chains globally, with disruptions stemming from diverse sources such as natural disasters, labor strikes, and geopolitical tensions. Understanding these challenges helps forest products managers anticipate and mitigate risks.

- Strikes Impacting Key Industries

On October 1, approximately 45,000 dockworkers initiated a strike, halting operations at ports from Maine to Texas. This was the first such action since 1977, and it was expected to cause significant disruption to ocean shipping. Though the strike ended after three days with a temporary suspension agreement, the tissue and towel sector still saw effects.

The fear ignited by the pandemic-induced toilet paper shortage led to anticipatory consumer buying, causing shortages. Although over 90% of toilet paper purchased in the US is produced domestically—transported by rail or truck and unaffected by port closures—consumers started panic buying upon news of the strike. Social media was flooded with reports of empty shelves, fueling the frenzy.

2. Geopolitical Tensions Alter Trade Routes

Geopolitical tensions also played a significant role in 2024’s supply chain disruptions. Early in the year, many large container shipping lines decided to avoid the Suez Canal due to attacks on commercial vessels in the Red Sea.

The alternative route around southern Africa increased the typical Asia-Europe voyage by 6,000 nautical miles, resulting in delivery delays. These delays created various effects for the forest products industry, especially concerning transportation costs and timely deliveries.

Earlier this year, GEP reported an 80% decline in maritime traffic through the Red Sea and Suez Canal compared to pre-crisis levels. Fleets from carriers opting for diversions accounted for 62% of the world’s shipping capacity.

Consequently, global shipping rates have soared. Tim Denoyer, a senior analyst at ACT Research, noted, “For instance, the cost of shipping a container from Shanghai to New York has tripled this year.” According to Marketplace, a container that cost $3,000 to ship at the start of the year now costs $7,800.

3. Natural Disasters Disrupting Logistics

In the Southeast United States, two major hurricanes struck within weeks of each other and severely damaged numerous areas. Ports were damaged, transportation routes blocked, and many goods delayed.

Hurricanes can impact timber and forestry in multiple ways, including:

-

High winds knocking over, uprooting, and otherwise damaging trees

-

Flooding large areas from rain and storm surge

-

Slow tree death from excess salt in the soil

-

Saturated ground delaying or preventing harvest

-

Limiting transportation access

-

Destruction of harvesting equipment, trucks, and mills

When assessing the damage done, the Georgia Forestry Commission (GFC) estimates a total timber resource impact from Hurricane Helene of $1.28 billion, WSAV-TV reports. The hurricane in late September affected 8.9 million acres of Georgia forestland.

How Can Forest Products Professionals Navigate Future Market Disruptions?

Navigating market and supply chain disruptions requires foresight and strategic planning. Fortunately, market intelligence can alleviate some uncertainty, offering a clearer understanding of the market landscape.

ResourceWise offers a range of tools, including pricing, mill intelligence, analytics, and strategic consulting specifically designed for the forest products value chain. These resources help businesses counterbalance uncertainty and make informed decisions during disruptions.

Here’s how forest products professionals can use market intelligence to their advantage:

Market Intelligence to Navigate Labor Strikes

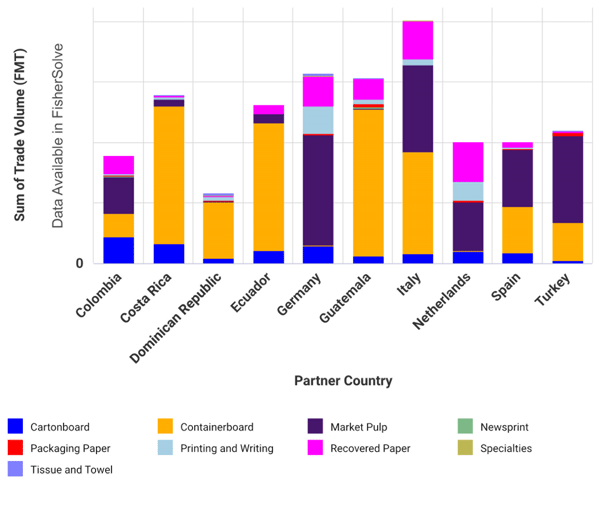

Consider the US port strike scenario. If prolonged, exports out of the US would be greatly impacted. Professionals could use FisherSolve to identify which major pulp and paper grades would be most affected and which trade partners would be involved.

The graph below highlights the top ten importers from the US, excluding those from North America and Asia. Given that the October port strike was expected to affect ports along the Eastern and Southern coasts, its impact on Asia, Canada, or Mexico would likely be minimal.

Top 10 US Importers (Excluding North America and Asia)

Source: FisherSolve

This data enables companies relying on US exports for specific grades to assess how much of their capacity might be affected. They can leverage FisherSolve’s capacity and trade data to identify other companies in different regions that could potentially compensate for any loss. Additionally, companies aiming to increase their exports can pinpoint which major grades in various countries will be impacted, uncovering new opportunities for growth.

Analyzing the Impact of Route Changes

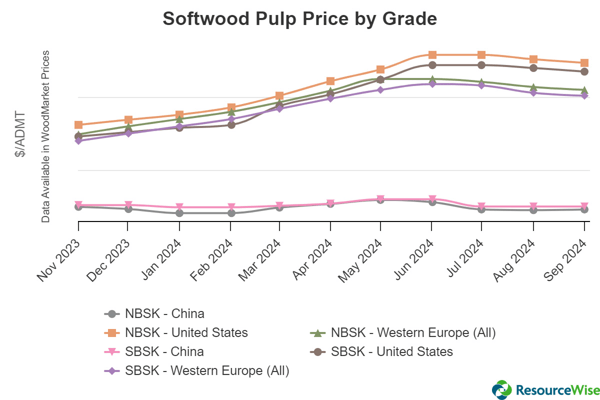

In the early days of the Suez Canal issue, ResourceWise-STE forecasts offered users the ability to anticipate increases in transportation times and their effects. For instance, when evaluating the market conditions and potential impacts on the softwood pulp sector, users could draw several conclusions.

By utilizing ResourceWise databases, it became evident that if transportation times for pulp shipments increased in the first quarter of 2024, the next turning point in softwood prices in China would be delayed. The delay would inevitably result in higher pulp prices. Additionally, the increased freight rates would lead to reduced softwood import volumes from Europe to China.

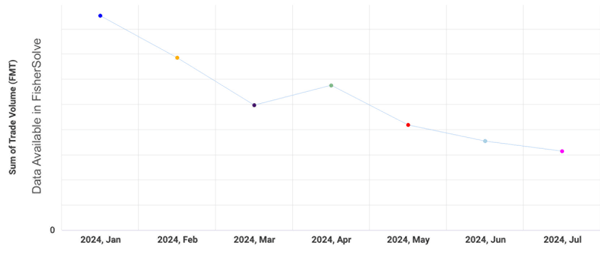

Reflecting on the market trends now, months after this forecast was made, we can confirm that the predicted trend indeed materialized. Analyzing soft kraft pulp trade data from FisherSolve reveals that exports from Europe to China decreased significantly as the year progressed.

European Softwood Kraft Pulp Exports to China

Source: FisherSolve

According to WoodMarket Prices, the cost of softwood pulp in China rose from March to June, stabilizing in July. A similar trend occurred in the United States and Western Europe, though the price fluctuations there were more pronounced.

Source: WoodMarket Prices

Assessing Natural Disaster Impacts

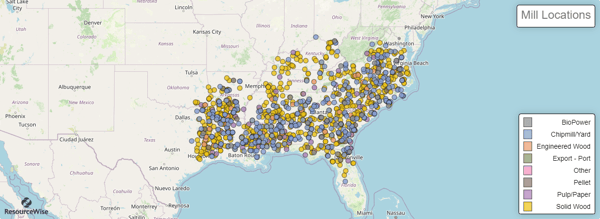

After the hurricanes, numerous companies dependent on the forests in the southeastern United States were left questioning the potential impacts on their operations.

SilvaStat360 offers valuable insights, including an interactive map that enables users to view a comprehensive overview of forests and forest products industry mills in the region. These features simplify the process of identifying those likely affected by the storms.

Geographic Summary – Mill Locations

Source: SilvaStat360

Users can also effectively assess the impact on stumpage tons and price per ton. For example, examining ResourceWise data from Brooks, Echols, Lowndes, Ware, Jefferson, and Madison counties in Georgia following Hurricane Helene indicates these changes in stumpage product groups:

-

Pine Pulpwood : 72% drop in price per ton compared to YTD average pre-Helene.

-

Pine Chip-n-Saw : 57% drop in price per ton compared to YTD average pre-Helene.

-

Pine Sawtimber : 49% drop in price per ton compared to YTD average pre-Helene.

-

Hardwood Pulpwood : 72% drop in price per ton compared to YTD average pre-Helene.

With a clear overview of the impacted areas, businesses can make informed decisions about resource allocation, logistics, and contingency planning to mitigate disruptions. Access to real-time data and insights helps companies stay competitive by adapting to changing market conditions and making data-driven decisions.

Market Intelligence Is Key

Utilizing market intelligence platforms, like those provided by ResourceWise, helps address critical questions during supply chain disruptions. These platforms offer insights into strategies buyers and sellers can use to manage situations effectively.

Strategic Questions to Consider

-

What are the best strategies for buyers and sellers to adapt to the current disruption?

-

How long might these disruptions impact the market?

-

What alternative supply routes or partners can be leveraged during such times?

By addressing these questions, companies can better prepare for and mitigate the effects of supply chain disruptions, maintaining stability in uncertain times.

Source: Strategic Pathways Through Market Disruptions in the Forest Products Industry