Posted on February 15, 2022 by Amanda Lang | no commentsin Forisk Market Bulletin, Structural Panels, Wood Demand & Procurement

Structural Panel Mill Investments Continue in North America

While significant forest industry capital continues to flow to the U.S. South, the announced acquisition of EACOM Timber Corporation in Eastern Canada by Interfor in late 2021 reminds us of the critical role and opportunities that exist for investors in Canada and elsewhere in the United States. Consider, for example:

- GreenFirst Forest Products acquired lumber and newsprint facilities in Ontario and Quebec from Rayonier Advanced Materials for US$214 million.

- Canfor announced the acquisition of Millar Western Products in Alberta for $327 million.

- Paper Excellence plans to invest $900 million to reopen pulp and paper facilities in Prince Albert, Saskatchewan and New Glasgow, Nova Scotia.

These select examples, along with Interfor’s $383 million acquisition of EACOM’s 7 sawmills in Ontario and Quebec, total over $1.8 billion of investment in mill infrastructure in Canada.

The structural panels sector has also been growing and investing across Canada and the United States. One Sky Forest Products announced a new OSB facility will be built on the Paper Excellence Prince Albert mill site in Saskatchewan. Last year, West Fraser restarted the Chambord, Quebec OSB mill and LP restarted their Peace Valley OSB mill in British Columbia. Huber is constructing a greenfield OSB mill in Cohasset, Minnesota for a 2023 start. In the U.S. South, West Fraser purchased the former GP Fairfax, South Carolina OSB mill and is investing $US70 million to upgrade and restart the mill in Q2 2022. Scotch Plywood has a Q2 2022 anticipated opening of the newly rebuilt facility in Waynesboro, Mississippi.

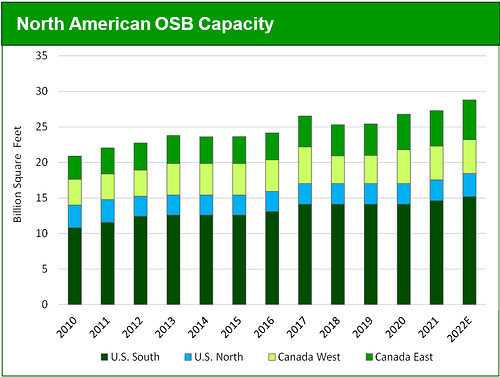

North American OSB capacity, while growing, has also shifted. Since 2011, total North American OSB capacity grew by a compound annual rate of 2.5%, gaining nearly 6 BSF over ten years. In 2021, OSB capacity grew 5% (+1.4 BSF), and projects to grow 3.7% per year for the next two years, given the investments noted above. While the U.S. South remains the major OSB-producing region, second place shifted from Western Canada in 2011 to Eastern Canada today, which increased capacity by over 50% in the past ten years. The U.S. North is the only region to lose capacity since 2011, though the region projects to gain capacity in the next two years. Moving forward, firms announced capacity increases in the U.S. South of 1.0 BSF and Eastern Canada of 0.6 BSF.

Source: Forisk North American Forest Industry Capacity Database