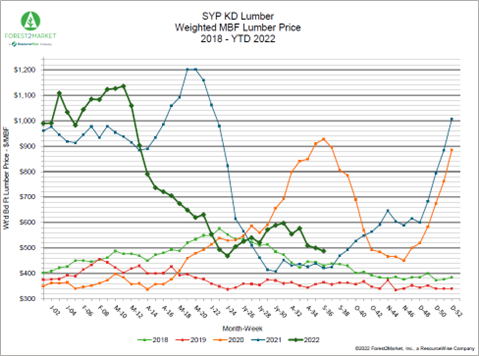

By late June, the price for finished southern yellow pine (SYP) lumber had tumbled 59% from its 2022 high mark of $1,136/MBF. Prices then subsequently bounced back, but weekly price movement has been range bound between ~$100 for the last 12 weeks, which is a departure from the wild volatility that was the norm over the last two years.

Forest2Market’s composite SYP lumber price for the week ending September 9 (week 36) was $488/MBF, a 2.4% decrease from the previous week’s price of $500/MBF, but a 14.9% increase over the same week last year. As illustrated in the chart below, price movement over the last 12 weeks has been muted compared to 1Q and 2Q suggesting there is now some stability in the supply/demand relationship as well as a new floor price in the +/-$470/MBF range.

It’s tough to tell how long the equilibrium will last; supply chains and lumber yard inventories have largely caught up from the panic buying that peaked in 1Q, and housing starts recently plunged to their lowest level in 17 months. “No one wants to own wood right now, and most are sure that the markets can’t get away from them,” wrote Bob Maeda at Oregon-based Freres Lumber. “That is mostly accurate, but thanks to super conservative buying strategies employed by most buyers, along with lean inventories and good demand in the field, one can envision a scenario where things could get livelier under the right circumstances.”

Will Lumber Prices Rally Again?

The lumber market has been unstable over the last 24 months because there has simply been too much noise for the market to find equilibrium. However, high housing costs, crippling inflation, and soaring interest rates are creating a real roadblock for first-time home buyers, and the pace of growth appears to be slowing as a result.

Forest2Market’s data suggests that flat/decreasing demand from the home construction sector and expanded mill inventories have created a market that is better attuned to current needs. This should limit substantial price reactions in either direction and provide some much-needed stability. But for how long?

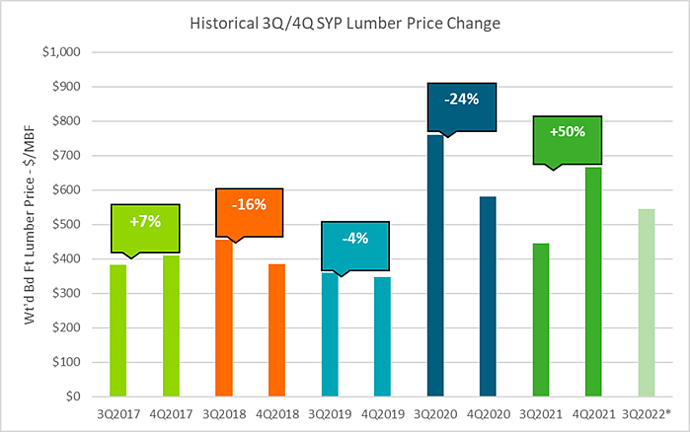

Looking at Forest2Market 3Q/4Q SYP lumber price data over the last five years, we see some interesting trends. Since much of the noteworthy volatility in both 2020 and 2021 developed during this period, it’s worth comparing price performance during these quarters to previous years. A closer look at the percentage change in average quarter-over-quarter (QoQ) SYP lumber price from 2017 - 2020 illustrates that prices typically decrease, with only one price increase in 2017. However, QoQ prices in 2021 surged by a drastic 50%.

3Q/4Q price change over the last two years could hardly be more divergent. In 4Q2022, will the market see a repeat of 2020, 2021, or will it resemble a less volatile year like 2019?

Now that existing home prices seem to be retreating in many markets, inventory levels are finally starting to bounce back. Between April and June, the number of homes listed for sale jumped to 1.26 million—the highest level since last September. Analyst Wolf Richter argued at least part of the apparent housing shortage “was really a refusal by homeowners who’d bought another home to put their old and now-vacant home on the market because they wanted to ride up the price spike all the way to the top. This has now been accomplished, and these vacant homes are appearing on the market.”

Even though demand for homes is now cooling, “builders will remain busy for some time working down backlogs of unfilled orders, even allowing for rising cancellations,” noted Richard Moody of Regions Financial. That said, we’ll have to wait for 4Q to develop to get a better feel for relative market strength and demand.