Homebuilder stocks plunged Monday following reports that the U.S. is preparing to sharply increase tariffs on Canadian lumber, independent of President Donald Trump’s new “reciprocal” tariffs.

The U.S. is preparing to raise duties on Canadian softwood lumber to 34.45% under anti-subsidy and anti-dumping rules, up from the level of 14.5% set last year, according to a Commerce Department memo reported by Bloomberg.

Canadian lumber, a key input for American homebuilders, had remained exempt under the new tariff regime Trump announced last week, boosting homebuilder stocks on Friday even as the broader market crashed.

After reports of the new lumber duties emerged over the weekend, however, shares of homebuilders plunged swiftly Monday, joining a broader market selloff that extended losses from last week.

The biggest publicly traded homebuilders, including D.R. Horton, Lennar, PulteGroup, and Toll Brothers, all suffered declines, with their stock dropping between 3.5% and 6.1% at the closing bell.

The major indexes ended trading mixed after a day of wild swings and volatility, with the Dow Jones Industrial Average and the S&P 500 both closing down less than 1% and the Nasdaq Composite inching higher by 0.1%.

“Tariffs are the clear culprit for the stock market pullback and fears of recession,” says Realtor.com® Senior Economist Joel Berner. “Recession risk is especially poignant for builders, who rely on the strength of the labor market to produce buyers for their new homes. Builders are reluctant to deliver inventory they feel like they won’t be able to sell at the prices they want.”

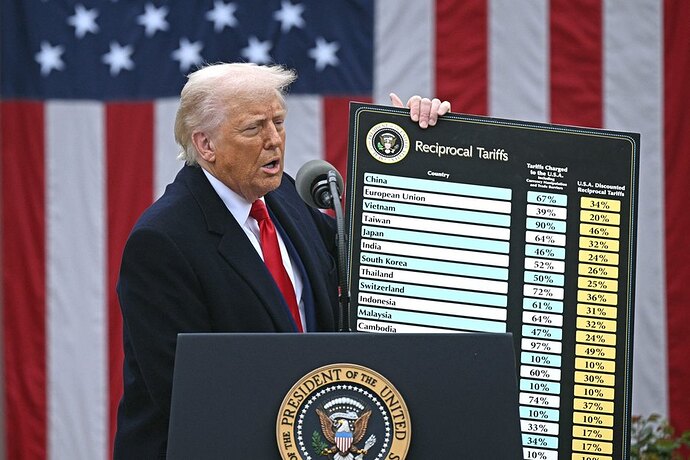

President Donald Trump announced his “reciprocal” tariffs during an appearance in the White House’s Rose Garden on April 2. (BRENDAN SMIALOWSKI/AFP via Getty Images)

On a call with investors last month, Lennar President and co-CEO Jon Jaffe said that the homebuilder had not yet experienced direct cost impacts from tariffs but was closely monitoring the issue.

“To date, we have had no impact to our costs from tariffs, and we’ll work closely with all our trade partners if further tariffs present themselves to mitigate and offset cost impacts,” he said on the March 21 earnings call.

Large homebuilders, like Lennar, are probably in the best position to weather tariffs, as their scale gives them greater leverage with suppliers than their smaller competitors.

The latest round of tariffs, however, will likely increase materials costs for all homebuilders, to some extent, with a recent survey of builders finding that they expect an average cost increase of $9,200 per home as a result of tariffs.

And their size would not protect large homebuilders from a recession marked by steep job losses, a scenario that economists view as increasingly likely as Trump pushes forward with his tariff agenda.

Over the weekend, Moody’s Analytics Chief Economist Mark Zandi raised his outlook for the odds of a recession this year to 60%, up from just 15% a few months ago.

“The start of this trade war is shaking economic confidence around the world, which makes its way into the housing market in the form of fewer willing buyers looking for homes,” says Berner. “Falling sales could lead to falling home values and real loss of wealth for homeowners all over the country.”

Canadian lumber tariff catches housing industry by surprise

First word of the increased duties on Canadian lumber came late Friday from the U.S. Lumber Coalition, a trade group representing American timber producers.

U.S. Lumber Coalition Chairman Andrew Miller praised the move in a statement accusing Canada of “abusive dumping and subsidies practices” in softwood lumber trade.

The premier of British Columbia, David Eby, confirmed the new levies in a statement on Saturday, slamming the new 34.45% rate as “an attack on forest workers and British Columbians” while denying allegations of unfair trade practices.

“We have friends and family in the United States who need Canadian lumber to build or rebuild their homes, and both Canadians and Americans need an end to this trade dispute,” said Eby.

However, the U.S. Commerce Department had not publicly announced the new lumber tariffs as of Monday afternoon and did not respond to a request for comment from Realtor.com.

The National Association of Homebuilders had advocated strongly against any new lumber tariffs and initially succeeded in exempting them from Trump’s across-the-board tariffs announced last week, as well as from the 25% temporary tariff he imposed on some Canadian goods in early March.

The new lumber tariff rate is entirely separate from Trump’s trade moves, however, and falls under anti-subsidy and anti-dumping rules.

A spokesperson for the NAHB declined to comment on the new lumber tariffs until they are publicly confirmed by the Commerce Department.

https://www.realtor.com/news/trends/tariffs-canadian-lumber-homebuilder-stock-market/