Besides all the market info from mills ,wholesalers and customers about the in flows and out flows of lumber this is what the “smart money people” use to guesstimate trends and moves. Happy Holidays and have an Awesome Day.

@Michael_Haas do you use any other “technical indicators” to time your entry and exit into the markets? Have you ever used the Residual Strength Index (RSI) and other stochastics? You can see an example of the RSI indicator on the home page of the Pakira Forum under the Lumber Futures chart. I wonder how many in the industry follow it?

@Jim_Schumacher @Matt_Layman @william_giguere What do you think of technical indicators?

Indicators like RSI indicators are a valuable tool that helps to determine stages of a market .

Interesting, glad I am not the only one following it. How did you find out about these tools @Michael_Haas?

I have a proprietary Indicatory, Forecasted Decision Points, FDP’s. which forecasts “when” our lumber market will rise and fall. 86% accuracy. The FDP’s are use by our members as a guide to accumulating or liquidating inventory positions.

Other indicators like Relative Strength Index are commonly used for futures but to my knowledge not applicable to cash…much too volatile and difficult to adjust inventory with futures prices , nor is it necessary. Example LLG’s next FDP is week #02, 2022…forecasting January Chaos whereby prices become negotiable and market seems uncertain. This FDP is a minor trend within the greater bull market which began at week #45 and continues through week #10.

@Matt_Layman Kudos to you, we need more solutions customized to the cash market. I am shocked by the lack of technology and data solutions offered in the cash market when compared to futures.

Is this link the best place to learn more about your Forecasted Decision Points?

https://www.laymansguide.com/lumber-market-forecasts

Yes sir

Lumber Forecasting You Can Use.

A reminder from Dec 21

3 weeks before it happened.

Matt Layman

I have a proprietary Indicator, Forecasted Decision Points, FDP’s, which forecasts “when” our lumber market will rise and fall. 86% accuracy. The FDP’s are use by our members as a guide to accumulating or liquidating inventory positions.

Other indicators like Relative Strength Index are commonly used for futures Example LLG’s next FDP is week #02, 2022…forecasting January Chaos whereby prices become negotiable and market seems uncertain. This FDP is a minor trend within the greater bull market which began at week #45 and continues through week #10.

(I invite all Pakira users to take advantage of my 2-month free trial. Actually, it is mandatory that you ride along for 2-months before applying for membership. Earn while you learn. Click any link on the website.)

www.laymansguide.com

Looking Forward,

ML

LLG’s next FDP is week #02, 2022…forecasting January Chaos whereby prices become negotiable and market seems uncertain.

You heard it here first folks. @Matt_Layman’s FDP predicted the crash in prices before it happened. Be sure to keep an eye out for his posts on Pakira and subscribe to Laymans Lumber Guide

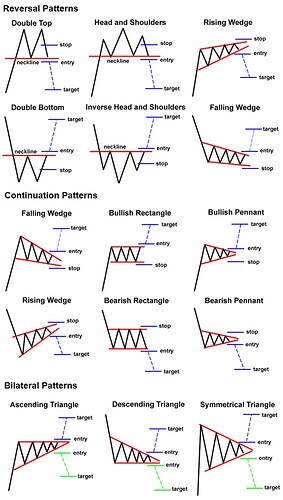

I’m in the wood and lumber products industry; however, I don’t trade lumber futures. Not related to my industry, I trade ETFs and use candlestick patterns, bullish and bearish chart patterns, RSI, stochastic, MACD, Fibonacci retracements and extensions, etc., because they work.

Lumber always fills gaps… !! You can rely on it 99.9% of the time as long as you got time and money to let trade work!!!