The normal seasonal slowdown for construction and building activity in autumn brings a drop in lumber prices. However it is unknown how much impact rebuilding after the recent very severe storms along the east coast of North America, both on the Canadian Atlantic provinces and for the US south, will have on looming lumber demand therefore prices.

Given that currently the devastation is still being assessed, it can be assumed that the need for lumber in the next few months will be greater than it normally is heading into winter. Thankfully there is a significant amount of production volume available to come online, as quite a few sawmills have been taking curtailments and downtime in recent months.

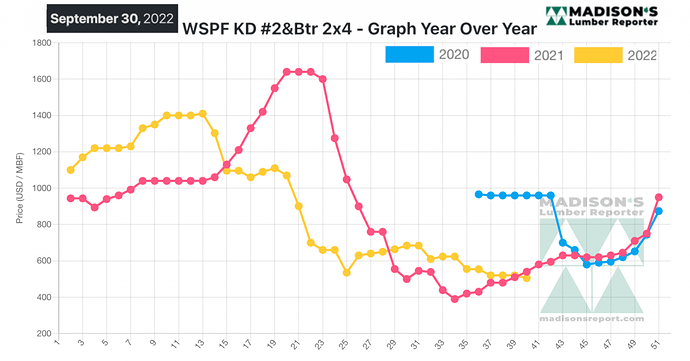

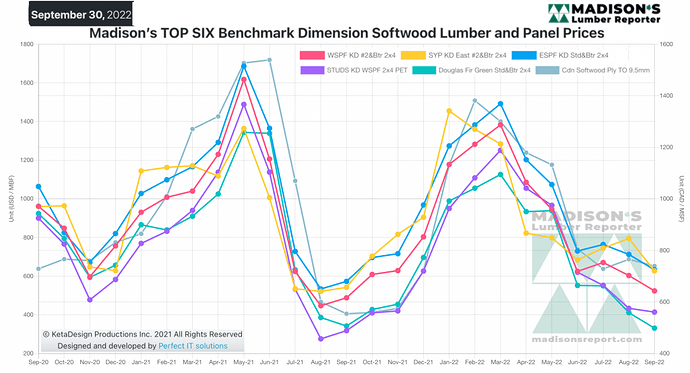

After holding flat for several weeks, in the week ending September 30, 2022, the price of benchmark softwood lumber item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$505 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter.

This is down by -$15, or -3% from the previous week when it was $520, and is down by -$98, or -16%, from one month ago when it was $603.

Order files at sawmills were into the weeks of October 10th or 17th, but as mentioned prompt material could be found with ease by motivated buyers.

Demand for lumber and panel was unmoved as yet, as horrific storm systems lashed Atlantic provinces and states.”

— Madison’s Lumber Reporter

The Western S-P-F market in the US was flat to slightly down. Buyers were already distracted and wary about new purchases in the face of waffling prices, rising interest rates, and overall inflation.

Hurricane Ian’s reign of destruction through Florida and other Southeastern states gave them further pause. Both primary and secondary suppliers had available on-ground stock, further reducing urgency from customers who needed to plug holes in their lean inventories.

The Western S-P-F market closed out September not with a bang, but a whimper according to suppliers in Canada. Prices of R/L dimension items were level or off between $15 and $43, with #2&Btr and #3/Utility wides taking the biggest tumbles. Buyers continued to lean heavily on the distribution network, happy to take advantage of aggressive secondaries competing with each other to keep their inventories lean of slow-moving items.

Order files at sawmills ranged from three weeks out to prompt, with plenty of the latter apparently showing up on a day-to-day basis – especially in 2×4. Supply of wider offerings was more sporadic.

Sales of Eastern S-P-F commodities started on a listless note this Monday, especially compared to the strong finish observed late last week. Eastern Canadian sawmills tried to stay firm on their asking prices. Buyers were active in spurts, and sales volumes were again on the low side in most cases.

Caution reigned as players’ attention was often diverted by persistently dire economic indices. Supply appeared to be ahead of demand, but not by much.”

— Madison’s Lumber Reporter