Will the material be the next Chinese drywall, or are American manufacturers trying to exclude a cheaper alternative from the market?

This feature is a part of “The Dotted Line” series, which takes an in-depth look at the complex legal landscape of the construction industry. To view the entire series, click here.

Is Brazilian plywood the next Chinese drywall, or are American manufacturers just trying to exclude a cheaper alternative from their market?

That’s the question contractors need to consider as a dispute between the U.S. Structural Plywood Integrity Coalition and third-party certification firms continues to play out in federal court.

In May, a federal judge in the Southern District of Florida barred PFS-TECO, a Wisconsin building products ratings firm, from giving U.S. PS1 standards certification to plywood mills in southern Brazil. The injunction also required the firm to revoke any existing PS1 certificates and grade stamps already issued.

But just weeks after the injunction was issued in late May, another firm, Forestwood Industries Inc. of Wading River, New York, started giving its own PS1 certificates to the same mills in Brazil. The U.S. plywood coalition then filed a request for another injunction against Forestwood, too.

“It does seem to be kind of curious that just days after the permanent injunction was issued, you suddenly have this new company that popped up for certifications, and everything was in line and ready to go,” said attorney Jeff Thomen, a partner at McCarter & English in Hartford, Connecticut, who specializes in construction defect claims. “It’s kind of almost a whack-a-mole situation.”

At the phone number listed for Forestwood Industries Inc., a person answered Construction Dive’s call with the greeting, “Evergreen Forest Products.” After confirming the number was also used for Forestwood Industries, the person said the firm had no comment on the Brazilian case. After declining to give her name, she hung up.

In a filing Monday responding to the request for the new injunction, Forestwood’s lawyers disputed the plywood coalition’s characterization of it as a “fly-by-night” organization. “Forestwood is a company with deep roots in the lumber production industry, extensive experience in evaluating and assessing the quality of plywood, and is fully compliant with the duly-issued accreditations by its co-defendant,” the firm’s filing read.

The weight of the PS1 standard

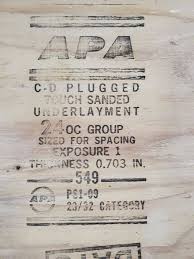

The PS1 standard applies to structural plywood, and is required in most U.S. building codes for panels to be used in walls, roofs and flooring. Contractors must install PS1 sheets with their stamps facing down on roofs and up on floors so building inspectors can confirm materials meet code.

The May 23 injunction stems from a 2019 lawsuit filed by the plywood coalition, which comprises nine U.S. plywood companies, alleging PFS-TECO wasn’t performing adequate testing of the Brazilian plywood, but issued the PS1 stamp anyway. The result was false advertising, the complaint alleged.

Since southern yellow pine grows faster in southern Brazil than in the U.S., the coalition argued, Brazil’s pines produced veneer that is significantly less dense and therefore weaker. It said it commissioned four independent tests that showed Brazilian PS1 plywood failed bending stiffness requirements at least half the time.

“This off-grade material masquerades as PS1 compliant,” said Michael E. Haglund of Haglund Kelley LLP in Portland, Oregon, the law firm representing the coalition.

Haglund compared the situation to the infamous Chinese drywall issues of the mid 2000s. Then, contractors had to make call backs for drywall that allegedly caused health issues to occupants and other damage in numerous buildings, often having to rip it out.

In his release announcing the court’s injunction, Haglund argued the order effectively mandated suppliers to either remove the PFS-TECO-issued PS1 grade stamp on each existing panel in their inventory before resale, or destroy the panel entirely.

“As a result, everyone currently holding this inventory is now on notice that it should be considered off-grade,” Haglund said.

But questions remain.

The faster growth cycle also allows Brazilian mills to sell their panels at steep discounts to U.S. suppliers, which means the coalition has a business motive to call out the Brazilian wood. In 2021, Brazilian plywood accounted for 11% of U.S. supply with nearly 1.2 billion square feet sold.

Asked whether the litigation was simply an attempt by U.S. manufacturers to bar a cheaper, foreign competitor, Haglund said no.