WRI Market Insights 2022

Global Sawlog Markets

Global sawlog price changes were mixed in the 1Q/22 with q-o-q increases in North

America and Eastern Europe, while prices declined in Central and Northern Europe, reports

the Wood Resource Quarterly. While the price changes from the 4Q/21 to the 1Q/22 have

only been modest, the current price levels are much higher than they were a year ago. For

example, prices from the 1Q/21 to the 1Q/22 surged the most in British Columbia (+58%),

Central Europe (+33%), and the Baltic States (+20%). Even in the US South, where log

prices generally don’t move much, sawlogs costs have increased by almost 10% in 12

months.

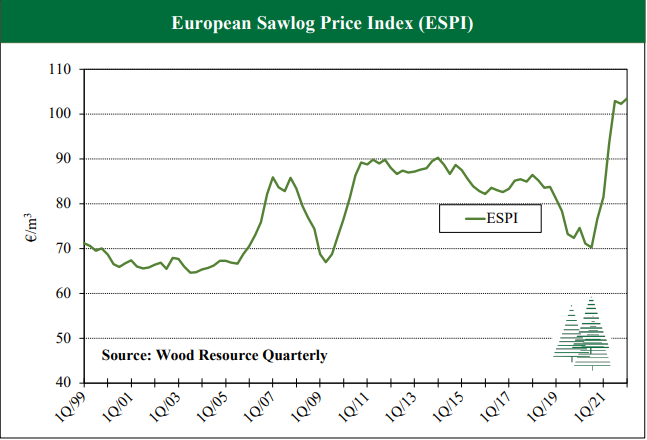

The Global Sawlog Price Index (GSPI) fell slightly in the 1Q/22 but was still 11% higher

than in the 1Q/21 and the second highest moment in time in over ten years. On the other

hand, the European Sawlog Price Index (ESPI) increased slightly q-o-q and reached a

new all-time high of €103.54/m3, 27% higher than just a year ago (see chart)

Global trade of softwood logs slowed substantially in early 2022 because of reduced house

construction and remodeling activities in Europe, North America, and Asia. As a result,

worldwide trade fell over 20% y-o-y, with the most significant declines occurring in

imports to China (-42%), India (-32%), South Korea (-14%), and Austria (-14%).

Exporting countries that reduced shipments the most during the first quarter of 2022 were

Russia, New Zealand, Germany, and the Czech Republic. Practically no softwood logs

were exported from Russia in 2022, a result of the Russian log export ban implemented on

January 1, 2022, and the trade sanctions because of the Ukrainian war. The current almost

non-existent trade flow marks a sharp deviation from former quarterly shipments, ranging

between 1-2 million m3 during the past few years. Exports from New Zealand, the world’s

largest log exporter, fell to 4.6 million m3 in the 1Q/22, the lowest level in two years.

Credit to

Wood Resources International LLC, a ResourceWise Company

Hakan Ekstrom, Seattle, USA

info@WoodPrices.com