The Global Sawlog Price Index fell late in 2022 following a 40% gain over two

years

Wood raw-material costs for sawmills in North America and Europe eased in the 3Q/22 as

demand and prices for lumber fell. A few countries faced slight log price increases in their

local currencies, but with the strengthening US dollar, practically all markets worldwide

had lower log costs in dollar terms compared to the 2Q/22. As a result, the Global Sawlog

Price Index (GSPI) fell about five percent from its all-time high in the previous quarter.

Since the index fell to a ten-year low in early 2020, it has climbed steadily and was up 40%

over two years.

Unprecedented strong markets for wood products and record-high lumber prices caused

record demand for wood raw-material in both Europe and North America during 2021 and

early 2022. On a worldwide basis, softwood sawlog prices (in US$ terms) have gone up

the most since 2020 in Brazil (+76%), Western Canada (+70%), Estonia (+68%), and

Germany (+59%). Only the Nordic countries, Oceania, and China, have seen more modest

price adjustments in the past few years.

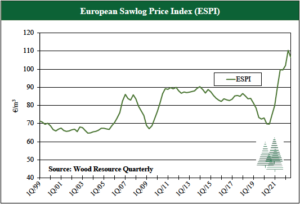

The European log market has undergone dramatic changes in supply and demand over the

The past five years resulted in the most substantial price fluctuations the Wood Resource

Quarterly has observed in almost 30 years of tracking wood markets. In 2017, sawlog

prices were at levels that had been practically unchanged for nearly a decade. The situation

changed when Central Europe was flooded with insects and storm-damaged timber in

2018-2020, and log prices fell to the lowest levels in over ten years.

High demand for lumber, declining availability of quality logs in the Czech Republic and

Germany, and reduced log imports from Belarus, Russia, and Ukraine resulted in a surge

in log prices on the continent. Consequently, the European Sawlog Price Index (ESPI)

jumped over 40% from 3Q/20 to 2Q/22, reaching an all-time high of just over €110/m3 in

the spring of 2022 (see chart). In the 3Q/22, lumber demand weakened, thus reducing

upward price pressures on sawlogs and even declining prices in many markets.

WRI Market Insights 2023

- a subscription service from Wood Resources International

Global Sawlog Markets

Nevertheless, prices continued to be the highest in Central and Eastern Europe, while

sawmills in the Nordic countries continued to have substantially lower raw-material costs

than their European competitors.