The housing market slump is a real pain in the butt — it’s even making toilet paper more expensive.

With less demand for new houses, the need for lumber slows. As lumber falls into slumber and futures drop over 60% to a two-year low of below $350 per thousand board feet from as high as $1,400 per thousand board feet during the height of the recent price spike, sawmills are winding down.

And the wind-down is happening in a big way. In Canada, the largest softwood lumber producer globally, Bloomberg reports that about a third of British Columbia’s sawmills have now closed operations. These closures impact the production of paper-based products, including toilet paper, because their raw materials are byproducts, like wood pulp, produced at the mills.

What’s more, toilet paper is a delicate product, so to speak. Substituting cheaper fiber from lower-quality wood pulp will just cause more pain in the butt, so to speak. British Columbia produces a premium kind of softwood pulp that produces high-quality toilet paper that’s both sturdy and soft.

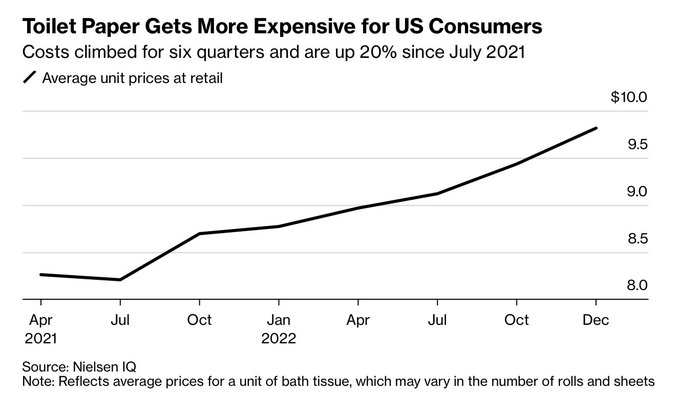

With a significant capacity of the sawmills in the region gone comes a squeeze, and with that comes higher costs. Prices at US retail have gone up 20% from July to December 2022, according to data from NielsenIQ. The period coincides with the beginning of the fall of the lumber market.

According to Bloomberg, Brazilian pulp company Klabin SA last week confirmed that with the tighter market, pulp producers around the world have hiked prices by as much as $30 per metric ton, bringing prices to $970 from $940 per ton.

Consumers may have already learned how to work around a toilet paper squeeze from when it first happened during the early part of the pandemic. Maybe it’s finally time to make bidets happen, yeah?

Toilet paper producer Kimberly-Clark Corp reported a 2.9% drop in retail sales from October to January 28 when the company raised prices by 9.7%, according to a Barclays analysis of NielsenIQ data.

Analysts believe that lower consumption and more supply coming from Europe should soon offset the squeeze from Canada. Softwood pulp producers in Sweden and Finland will be ramping up their production capacity by 1 million tons annually by the second half of this year.

Source: Toilet Paper in Danger … Again, But This Time It’s the Housing Market’s Fault | the deep dive