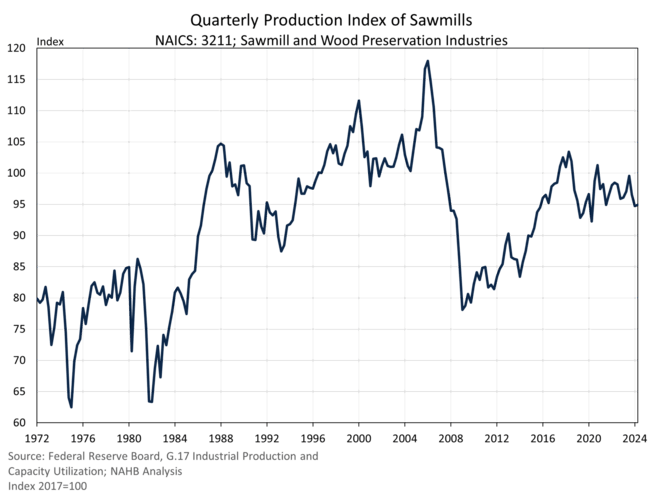

The production index for sawmills and wood preservation industries rose marginally by 0.2% in the second quarter of 2024. After falling for the previous two quarters, this was the first rise in real output since the third quarter of 2023 according to the G.17 data. The index was 2.2% lower than one year ago, the largest year-over-year decline since falling 4.7% in the fourth quarter of 2021.

Quarterly Survey of Sawmills Capacity Utilization

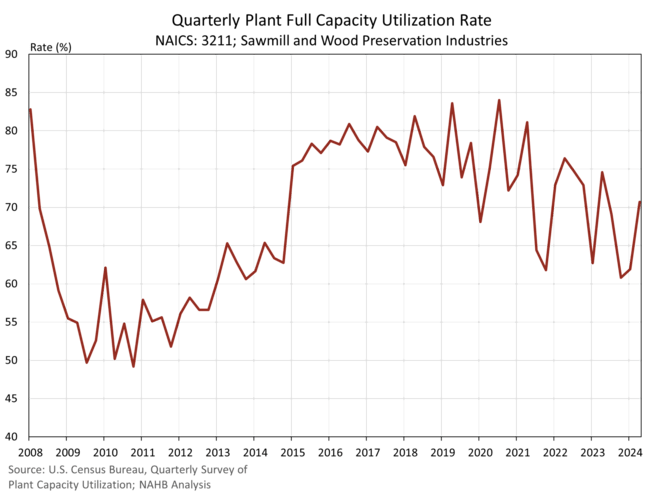

To provide a better understanding of the sawmill and wood preservation industries, the Census Bureau’s Quarterly Survey of Plant Capacity Utilization is another source of interest. This data comes from quarterly surveys of U.S. domestic manufacturing plants and includes a subindustry grouping of sawmills and wood preservation firms. The survey estimates utilization rates based on full production capability, meaning the utilizations rates are found by taking the market value of actual production during the quarter and dividing by an estimated market value of what the firm could have produced at full production capacity. In other words, the rate indicates how much production capacity is used to produce current output.

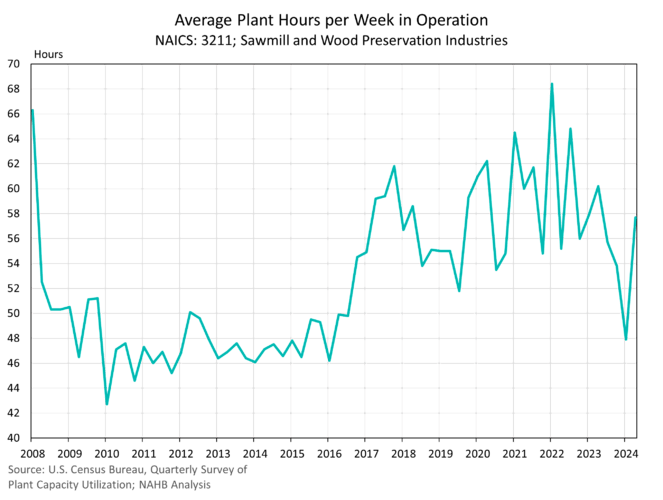

The sawmill and wood preservation industry full utilization rates jumped significantly over the quarter, up from 61.9% to 70.7%. Given this rise, it is surprising that production did not also increase significantly. Average plant hours per week in operation did rise for these firms, up from 47.9 hours in the first quarter to 57.7 hours in the second quarter.

Employment

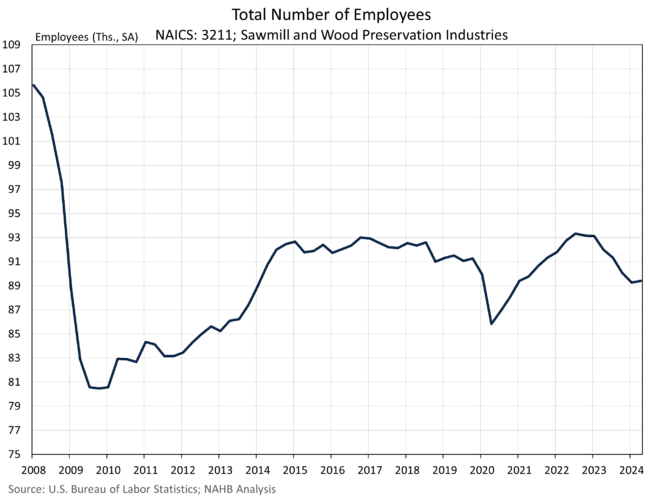

Employment at sawmill and wood preservation firms rose for the first time in six quarters, up to approximately 89,400 employees in the second quarter. The Great Recession had a substantial impact on this industry, as employment fell from 105,630 in the first quarter of 2008 to a series low of 80,470 in the fourth quarter of 2009. Employment rose from this low to 91,000 in 2014 and has remained around this level for the last ten years.

Capacity Index Estimate

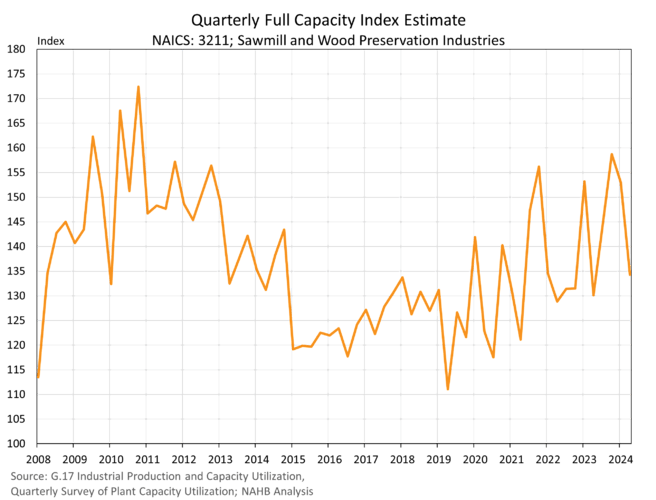

By combining the production index and utilization rate, we can compose a rough index estimate of what the current production capacity is for U.S. sawmills and wood preservation firms. Shown below is a quarterly estimate of the production capacity index. This capacity index measures the real output if all firms were operating at their full capacity.

Due to the volatility of the data, we compute a moving average of the utilization rate, production index and capacity index. These are four-quarter moving averages, which are shown below to provide a clearer picture of the industry.

Based on the data above, sawmill production capacity has increased from 2015 but remains lower than peak levels in 2011. Production by sawmills continues to be higher mainly because the mills are running at higher than historical levels of utilization, as shown in red above. Much of the addition in capacity has been recent, as utilization rates have fallen but production continues to run at higher levels. Despite the U.S. being largest producer of softwood lumber in North America, the current capacity and production levels do not meet the demand of U.S. consumers.

According to Census international trade data, imports remain critical to meeting U.S. demand for softwood lumber. In the month of September alone, imports of softwood lumber stood at 1.1 billion board feet. Canada was the primary country of origin, exporting 987 million board feet into the U.S. in September. The current Antidumping/Countervailing duty rate on these imports from Canada averages 14.5%. U.S. producers claim that Canadian softwood lumber production is subsidized by Canadian provincial governments, which allows Canadian producers to sell lumber at lower than normal market prices. The data indicates that since the expiration of the softwood lumber agreement in 2015, tariffs on Canadian softwood lumber have substantially benefited the U.S. lumber industry, allowing for expanded production capacity.