Despite mortgage rates averaging above 7%, single-family housing starts experienced an unexpected upswing in September. This positive trend is attributed to a growing number of buyers opting for new homes due to a scarcity of inventory in the resale market.

According to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, overall housing starts increased by 7% in September, reaching a seasonally adjusted annual rate of 1.36 million units. This figure represents the hypothetical number of housing units builders would commence if development were to continue at the same pace for the next 12 months.

Within this total, single-family starts experienced a notable 3.2% uptick, reaching a seasonally adjusted annual rate of 963,000. However, year-to-date, single-family starts are down by 12.8%, primarily due to the impact of higher interest rates. Conversely, the multifamily sector, including apartment buildings and condos, saw a significant increase of 17.6%, reaching an annualized pace of 395,000.

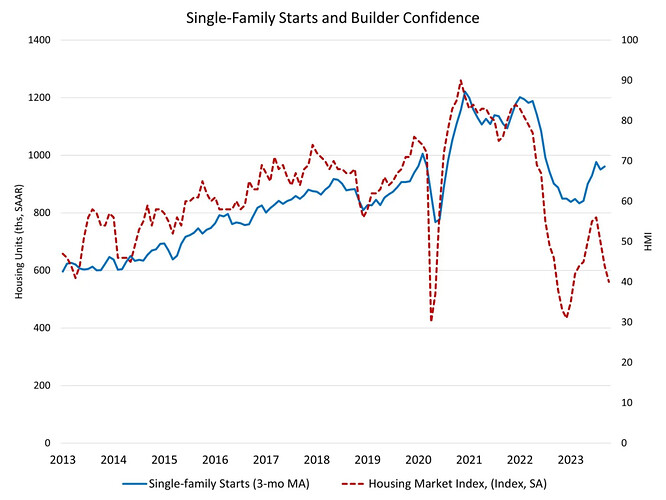

he unexpected strength in single-family starts may face potential downward revision in future reports, given the recent decline in the NAHB/Wells Fargo Housing Market Index, noted National Association of Home Builders. This index has decreased for three consecutive months, registering at just 40 in October, indicating a possible slowdown in the pace of single-family permits and starts during the final months of 2023.

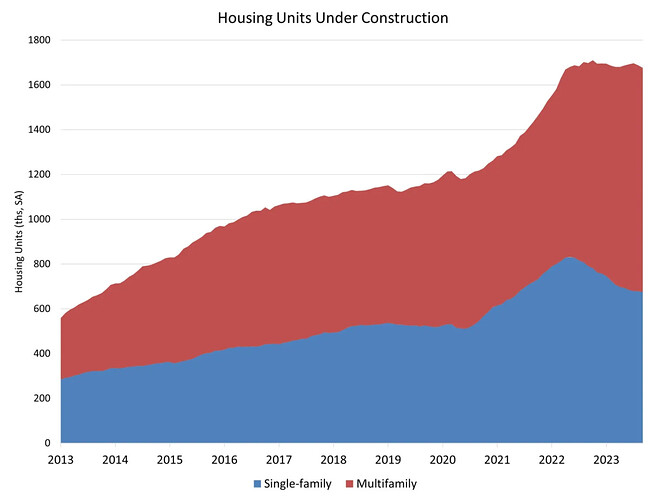

Despite challenges related to affordability, the scarcity of resale inventory continues to provide crucial support for builders in the market. In August, 31% of homes available for sale were new constructions, a significant increase compared to the historical average of 12%. However, the impact of higher interest rates is evident in the fact that the number of single-family homes under construction in September was 15% lower than the previous year.

The number of apartments under construction, totaling nearly 1 million units, is expected to decline in the coming months. Although the September level of total multifamily units under construction (1.002 million) is slightly lower than the cycle peak of 1.018 million in July, it remains more than 10% higher than a year ago.

On a regional and year-to-date basis, combined single-family and multifamily starts are lower in the Northeast (23.3%), the Midwest (12.9%), the South (7.8%), and the West (16.9%).

Permit data for September reveals an overall decrease of 4.4% to a 1.47 million unit annualized rate. Single-family permits, however, saw a monthly increase of 1.8%, reaching a rate of 965,000 units. Despite this monthly increase, single-family permits are down by 13.4% year-to-date. Multifamily permits decreased by 14.3% to an annualized pace of 508,000.

Examining regional permit data on a year-to-date basis reveals declines in permits across regions: 22.3% lower in the Northeast, 16.6% lower in the Midwest, 12.7% lower in the South, and 17.6% lower in the West.