The world’s shipping industry has called on the UN to provide military protection for commercial vessels in the Middle East after an escalation in hostile seizures by Iranian militia.

“We have seen a worrying increase in the attacks on shipping,” according to a letter co-signed by the world’s largest shipping operators, addressed to UN Secretary-General Antonio Guterres overnight, who said, “the world would be outraged if four airliners were seized and held hostage.”

Already, the European Union has deployed naval support to the region in a mission dubbed Aspides. Now, the European Community Shipowners Association Secretary-General stressed that “the situation is now spiralling out of control,” with the ECSA “encouraging all coordinated efforts, including diplomatic, which can contribute to the de-escalation of the crisis.”

It comes as global shipping has abandoned the Suez Canal, with the exodus threatening to scuttle supply chains and drive surging consumer prices (including timber) just as global inflation begins to ebb.

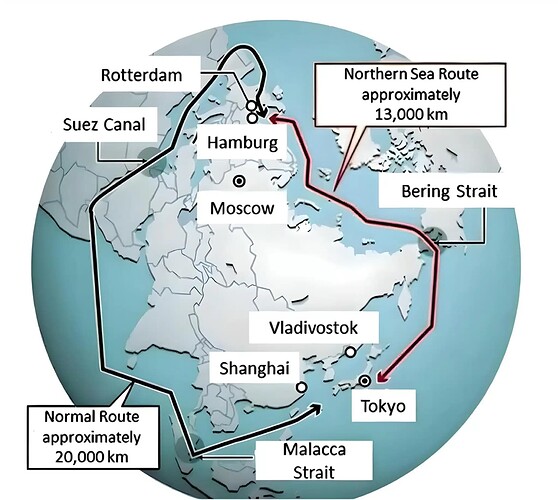

In December, Wood Central reported that China, India and the ASEAN block are looking to Northern Sea Routes with Russia as a hedge against the ongoing conflict in the Gaza Strip.

While the Suez Canal route between Europe and Asia is 21,000 km, the Northern Sea Route (NSR) cuts 8,000 km off the supply chain, effectively reducing sailing time from five-six weeks to under three weeks between Russia’s European Ports and Asian ports such as Shanghai.

In November, Wood Central reported on the location for an Arctic transhipment hub – which Russia and China could use to control global timber supply chains. (Photo Credit: Arctic transhipment hub planning along the Northern Sea Route: A systematic literature review and policy implications of Arctic port infrastructure*)

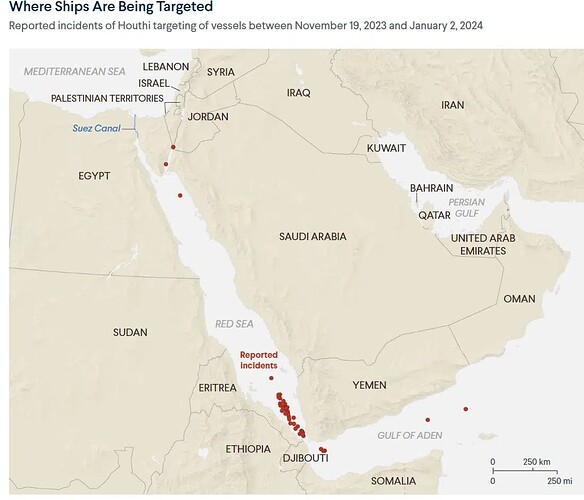

Now, Iranian-backed Houthi rebels have escalated attacks on vessels travelling through one of the world’s busiest shipping routes, drawing attention to the region – already reeling from Covid and the “Ever Given” disaster.

In January, the US, Australia, and eleven other countries affected by the disruption issued a statement condemning the attacks as “illegal, unacceptable, and profoundly destabilising”.

“Let our message now be clear. We call for the immediate end of these illegal attacks and release of unlawfully detained vessels and crew,” it said.

Wood Cental understands that timber, as a widely traded “bulky” commodity, is one of the most heavily impacted by the conflict. As one of the heaviest traded commodities, global shipping is the industry’s engine room.

According to the World’s Top Exports, global sawn wood sales totalled US$50.8 billion in 2022. The big six, including China, Canada, Russia, Sweden, Germany, and the US, are responsible for over 70% of exported timber and widely use the seaway.

Avoiding the Red Sea means abandoning one of the most common global shipping routes from Asia to Europe – with a surge in timber cargo entering European markets via China and the ASEAN region.

Indeed, until February 2024, more than 40% of Asia-Europe trade transited through the passage, with ships shunning the passage sailing around the Horn of Africa, adding up to $1 million in fuel and weeks to trips.

Already, more than 100 freight companies, including logistics giants Maersk, Hapag-Lloyd, Evergreen, and oil giant BP, have paused movements through a channel, while the insurance premiums for those brave enough to use the Red Sea have shot up nearly tenfold since the attacks began.

As a result, some shipping companies are already passing down these expenses. France’s CMA CGM, the world’s second-largest shipper by market share, recently announced that it would double its rates for shipping from Asia to Europe.

The impact has been significant, particularly for China, India, Vietnam, Thailand, Indonesia and European countries, including the United Kingdom, Germany, France, Spain and Italy.

In Australia and New Zealand – where 20% of bulk imports and exports connect to Europe – blockages in the global shipping system already impact furniture, food and clothing.

According to Sydney-based UTS Associate Professor Sanjoy Paul, the key is to develop new contingency plans that reduce reliance on single shipping routes.

“They include diversifying supply sources, being prepared to use alternative shipping routes and onshoring critical manufacturing,” he told SBS News Australia.

“Resources ought to be allocated now, and planning done in collaboration with local and international partners,” he said, adding that “the businesses that best prepare will be those best able to ride out and gain from the next disruption.”

Source: UN Must Act: Red Sea Crisis Disrupts Timber Supply Chains | Wood Central