Affordability has worsened considerably in 2023 and the existing housing inventory continues to flirt with record lows.

Demographics have contributed to this tight market, with millennials (those born between the early 1980s and mid-1990s), a cohort larger than the baby boomers, entering their prime home-buying years. Many millennials have become homeowners, but a significant portion of them are still waiting to jump into the housing market.

Not only are they facing tight inventory due to more homeowners keeping their ultra-low mortgage rates, but the competition for prime real estate has been exacerbated by continued buying by baby boomers. Mortgage rates have surged past 7.0%, dampening what had already been a challenging market to become a homeowner.

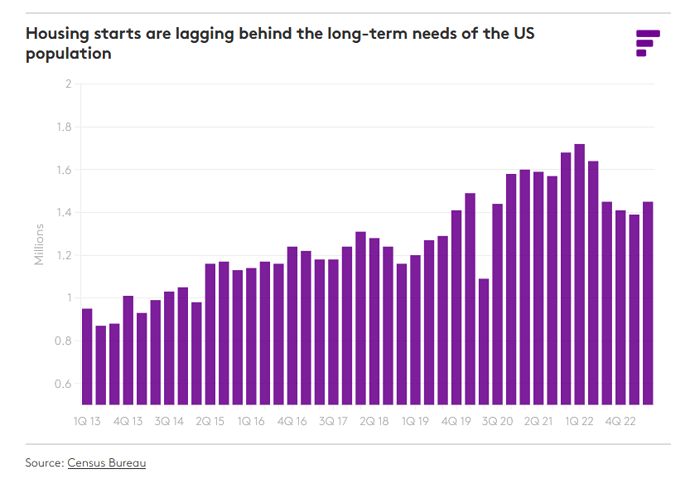

We know the challenges ahead for the housing market over the medium term, namely these higher borrowing costs. But the larger question looming is what do the demographics tell us about what we can expect longer term? Once we have these higher rates behind us, can we expect demographics to still be a strong tailwind? And an equally important question for market analysis is how truly under-built is the US housing market?

CBO projections are lower than the 2017 Census forecast

The Census, the projections Fastmarkets had been relying on, has not been updated since 2017. Fastmarkets thus pivoted to another reputable data source for the long-term demographic profile. The Congressional Budget Office (CBO) released its latest estimates by age class in January 2023; its projections are lower than what the Census predicted in 2017.

In 2037, the end of our forecast interval, the CBO currently projects the total US population will be 357.6 million, while the 2017 Census projected 368.4 million for that year – a difference of 11 million people. From 2023 to 2037, the CBO expects the US population to grow by about 0.4% per year, compared with the Census estimate of 0.6% per year, driven almost exclusively by immigration as birth rates will remain well below replacement rates over the forecast.

Despite rapidly rising mortgage rates, household formations trended well above 1.0 million units in 2022 and continued to do so in the first two quarters of 2023. In 2022, households rose by 1.7 million units, with households that owned homes significantly outpacing those that rented. The headship rate – the number of total households divided by the population – can be used to calculate a proxy for household size. But in a sign of how heated the housing market had become, those headship rates, while still low historically, have improved significantly.

In 2022, the headship rate of 25-34 year olds held at 44.6%, versus a low of 42.9% in 2017. The rate for 35-44 year olds also rose, to 51% in 2022 from a low of 49.2% in 2018. The improvement in the headship rate has been supportive of above-trend household growth despite the much slower population gains.

Headship rates could be even higher if not for the fact that the share of young adults living at home has been quite high, which is another element of the pent-up demand story. That share climbed after the Great Recession and has remained stubbornly high. The share hit a record level in 2020 as the pandemic hit young workers especially hard.