by Madison’s Lumber Reporter on October 27, 2022

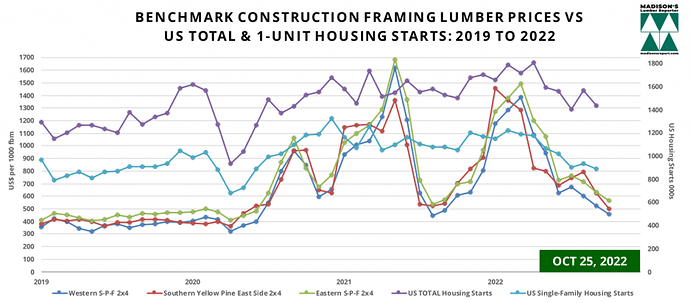

After a strong showing in the first half of this year, US housing starts and US new home sales for September 2022 dropped, reversing a small recovery seen in August.

While it is true that a slow-down is apparent in both construction and home buying activity, it is important to note that new building activity year-to-date remains higher than the first nine months of 2021.

Total housing starts in the US for September 2022 fell -8.1% to 1.439 million units compared to the 1.566 million units reported for August, and were down -7.7% from the September 2021 rate of 1.559 million. Data for August 2022 was revised lower, from the previously reported 1.575 million units. Yet total starts year-to-date are up +1.8% compared to January – September 2021.

Benchmark Softwood Lumber Prices Oct & US Housing Starts Sept: 2022

Meanwhile, building permits popped up, by +1.4%, to 1.564 million units from the revised August rate of 1.542 million. This is -3.2% below the September 2021 rate of 1.615 million. Data for August was revised quite a bit higher, from the previously reported 1.517 million units. During the first nine months of this year building permits were almost flat compared to the same period in 2021.

It is interesting to note that total permits in July were 1.685 million units, just +7.2% above starts for September. This indicates a good momentum for ongoing construction activity. That starts dropped in September is not alarming since it is the normal time of year, seasonally, for building to start slowing down.

Combined, there was a very high 1.735 million units under construction, 822,900 of those single-family homes. This is well abovethe historical record-high of 1.628 million units that were under construction in 1973. These will eventually become starts and help to underpin residential construction.

September starts of single-family housing, the largest share of the market and construction method which uses the most wood, reversed an increase last month, to fall -4.7% to a rate of 892,000 units. Single-family authorizations were at 872,000 units, which is -3.1% below the August figure of 900,000 units. Building permits are generally submitted two months before the home building is begun, so this data is as indicator of November construction activity.

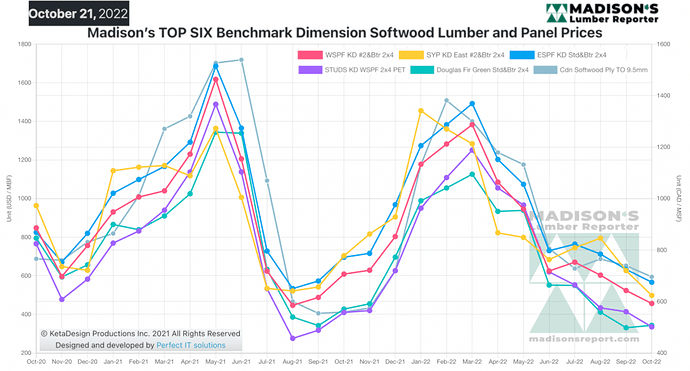

Madison’s Benchmark Top-Six Softwood Lumber and Panel Prices: Monthly Averages

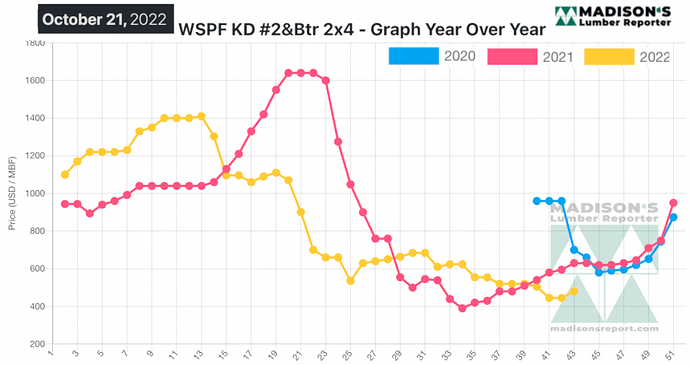

Looking at lumber prices, after several weeks of drops, for the week ending October 21, 2022 the price of benchmark softwood lumber item Western S-P-F 2×4 #2&Btr KD (RL) reversed course and rose, to US$480 mfbm, said weekly forest products industry price guide newsletter Madison’s Lumber Reporter. This is up by +$35, or +8% from the previous week when it was $445, and is down by -$44, or -8%, from one month ago when it was $524.

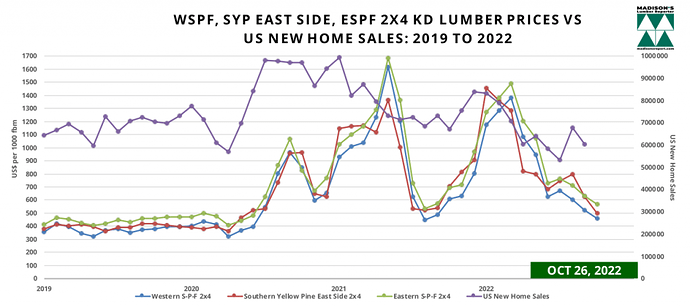

The U.S. Census Bureau and the US Department of Housing and Urban Development released October 26 new home sales and house price data. New home sales comprise 10% of real estate activity and are considered a leading housing market indicator as they are recorded when contracts are signed.

After a pop the previous month, sales of new US single-family homes dropped again in September. There were 603,000 new single-family homes sold last month, which is down -10.9% from the downwardly revised August rate of 677,000 and is a -17.6% drop compared to September 2021 when it was 732,000.

Only 6,000 new homes sold last month were below US$300,000.

At the sales pace in September it would take a lengthy 9.2 months to clear the supply of houses on the market, up from 8.1 months in August.

There were 462,000 new homes on the market at the end of last month, up from 457,000 units in August. Houses under construction made up 65% of the inventory, with homes yet to be started accounting for 23%.

Completed houses accounted for 12% of the inventory, well below a long-term average of 27%.

Benchmark Softwood Lumber Prices Sept & US NEW Home Sales Aug: 2022

The median sales price shot up, by +7.2%, to US$470,600, from US$436,800 in August. The September price is up +14% from one year ago, when it was $413,200. It is important to note that US new home prices rose sharply through all of 2021 and most of this year to date.

As for those lumber prices, compared to the same week last year, when it was US$630 mfbm, the price of Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending October 21, 2022 was down by -$150, or -24%. Compared to two years ago when it was $700, that week’s price is down by -$220, or -31%.