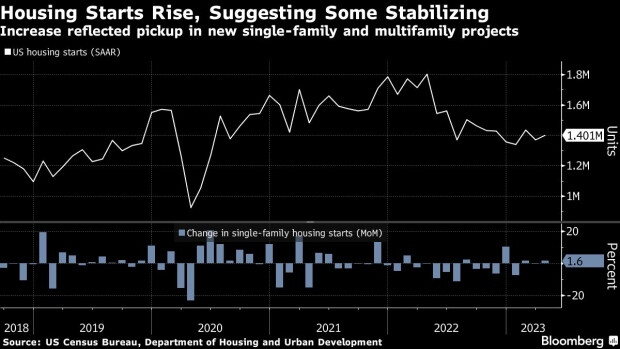

(Bloomberg) – US housing starts increased in April, adding to evidence that residential real estate is gradually recovering after a yearlong slump.

Beginning home construction rose 2.2% to a 1.4 million annualized rate, according to government data released Wednesday. Single-family homebuilding increased 1.6% to the highest level this year, entirely due to a jump in the West. Starts of apartment buildings and other multifamily projects also rose.

Applications to build, a proxy for future construction, fell 1.5% to an annualized rate of 1.42 million units. Permits for one-family dwellings, however, increased to a seven-month.

“While elevated mortgage rates and affordability concerns remain headwinds for housing, a lack of inventories could support building activity over time,” Rubeela Farooqi, chief US economist at High Frequency Economics, said in a note.

Builders are taking advantage of an historically low supply of existing homes for sale and some are offering financing incentives to ease affordability constraints amid budding demand for new houses. That helps explain why homebuilder sentiment currently stands at a 10-month high.

Still, prospective buyers face a number of headwinds that include only modest declines in home prices, still-high mortgage rates and tighter lending standards.

While Federal Reserve officials have indicated they may pause their tightening campaign as soon as next month, the extent to which rates will remain elevated is still unclear.

The rise in single-family home construction reflected an almost 60% surge in the West after slumping a month earlier.

The number of homes completed dropped to a 1.38 million annualized rate. The level of one-family properties under construction slid 1.4% to 698,000.

The housing starts data will feed into economists estimates of home construction’s impact on second-quarter gross domestic product. Prior to the report, the Federal Reserve Bank of Atlanta’s GDPNow called for residential investment to subtract 0.25 percentage point from growth.

Existing-home sales data for April will be released on Thursday, while a report on new-home purchases is due next week.

–With assistance from Kristy Scheuble.

(Adds graphic)

©2023 Bloomberg L.P.