By Ryan Dezember

Photographs by Amanda Andrade-Rhoades for The Wall Street Journal

Nov. 2, 2022

PISGAH, Md.—A major player in credit markets has made one of the largest U.S. timberland purchases in years, laying Wall Street’s biggest wager yet on forest carbon markets.

Oak Hill Advisors LP, a subsidiary of T. Rowe Price Group Inc. TROW -1.96%decrease; red down pointing triangle that manages $56 billion and is best known as a corporate-debt investor, said that it led a consortium to pay about $1.8 billion for 1.7 million acres of forest.

The properties spread over 17 eastern states and will be overseen by a unit of environmental-markets firm Anew Climate LLC. Oak Hill last year joined with Anew’s subsidiaryBluesource Sustainable Forests Co. to acquire and manage timberland to maximize how much carbon is stored in the standing trees rather than how much wood is produced from cutting them down.

Anew says that, between the 1.7 million acres acquired from the Forestland Group, a liquidating investment firm, and earlier purchases of about 100,000 acres, it is one of the 10 largest U.S. timberland owners. It is the only one among them focused on carbon markets instead of feeding lumber and pulp mills.

Anew plans to throttle back logging. It expects just 10% to 20% of revenue from the properties will come from harvesting wood, compared with 80% to 90% of the top line under the previous owner, said Jamie Houston, who leads the Anew unit.

“We’re really going to be focused on forest health,” he said. “We’re thinking about this in decades, not years.”

The market for forest-carbon offsets has boomed in recent years as companies sought ways to make up for their greenhouse-gas emissions. The idea behind forest offsets is to pay timberland owners to log less so that the trees keep growing and accumulating carbon.

Polluters can use offsets to cover some of their tab under California’s regulated cap-and-trade system if the landowners follow guidelines that can encumber properties for more than a century.

Increasingly, offsets are sold in so-called voluntary markets in unregulated transactions. Companies use voluntary offsets to scrub carbon from the environmental balance sheets they maintain for investors, and for public relations. Prices for voluntary offsets vary widely and terms range from a year to decades.

Critics of offsets say that many promised harvest reductions are merely theoretical, either because the forests are too remote or rugged to be logged economically or the owners aren’t generally in the business of clear-cutting. And that even when there are fewer harvests, demand from mills means more intense logging elsewhere. An overarching criticism is that offsets allow companies to pay a relatively small price to avoid reducing emissions.

Carbon markets have been jammed up lately by companies demanding offsets that represent actual harvest reductions, according to participants in the opaque markets. Landowners have created offsets at a rapid clip, but they have held out for higher prices to justify less logging.

Oak Hill and Anew say they are in no hurry to sell offsets and are content to let carbon amass on the properties while markets mature.

“Ultimately, creating a balance sheet of these assets should be valuable because everyone else has it on the liability side,” said Adam Kertzner, Oak Hill senior partner.

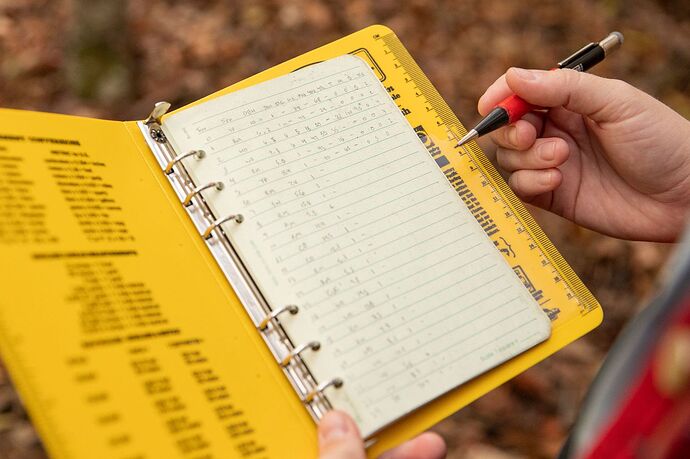

This winter, when leaves have fallen and trees are easier to measure, Anew will dispatch foresters to establish baseline volumes of biomass from which the accrual of carbon will be measured, said Cakey Worthington, vice president of carbon operations.

The 56 properties are mainly hardwood forest and range from Michigan’s Upper Peninsula down to Louisiana’s Atchafalaya Basin, over to the Apalachicola River in Florida, up through Appalachia and to New York’s Adirondack Mountains.

The Forestland Group raised funds from endowments, wealthy individuals and other big investors starting in the mid-1990s and bought the timberland from families and small mills. The strategy was to stand apart from rival timberland investors by focusing on naturally regenerating forests instead of the South’s monoculture pine plantations or the Pacific Northwest’s planted slopes of spruce and fir.

For one, there was less competition to buy slow-growing deciduous forests that supply wood for furniture, flooring and cabinetry than for the stands of softwood, such as pine, that are harvested to make lumber and mashed into pulp for delivery boxes and coffee cups, said Blake Stansell, who was president of the Forestland Group and is among about 15 employees joining the timberlands’ acquirer.

Prized species were promoted by sculpting the canopy to control where sunlight hit the forest floor, leaving the best specimens to reproduce after harvests and then taking them out once the little ones were ready to really grow. The funds had reached their lifespan and were being liquidated, putting the biggest assemblage of U.S. hardwood forests on block.

Oak Hill, which had been aiming to buy $500 million of timberland, rounded up more investors to buy all of the Forestland Group’s holdings. More than 150 foresters fanned out to size up each property.

One property, 10,400 acres outside Washington, D.C., on the Maryland side of the Potomac River, features American beech, black cherry and yellow poplar interspersed with loblolly and Virginia pine.

Anew is reducing harvests and will manage it to promote the growth of the woods, not just the trees with the most value at mills, Ms. Worthington said.

In a small plot where the trees were measured to serve as a sample for how much carbon is held in ecologically similar parts of the property, she pointed out what would be wasted in a typical harvest but has value in carbon markets: holly bushes and sweet gum that fall under equipment treads, a towering yet hollowed beech, and a black cherry bent like a lightning bolt and unsuitable for a sawmill.