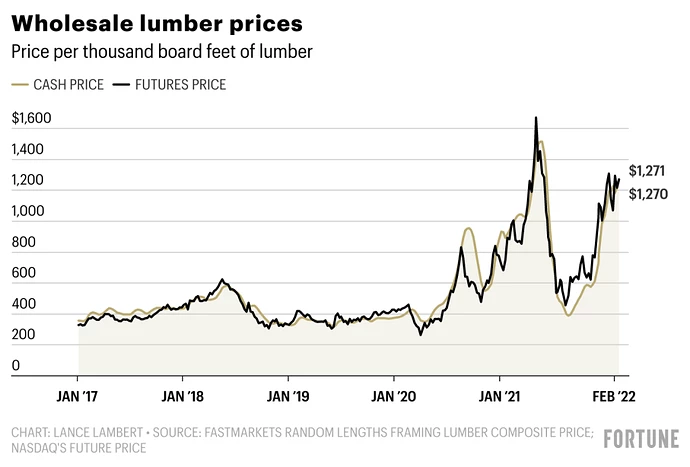

When the lumber bubble burst in the spring of 2021, it was expected to be the end of the mania. But here we go again: As of Friday, the cash market price of framing lumber hit an eight-month high of $1,271 per thousand board feet. That marks a 227% uptick since August, when it cost $389 per thousand board feet, and it isn’t too far off from the all-time high of $1,515 per thousand board feet set in May 2021.

It’s understandable that some do-it-yourselfers and homebuilders are having 2021 lumber bubble déjà vu. In fact, many industry insiders tell Fortune we are currently amid another run on lumber prices that is once again likely to end in a price correction.

“Market spikes like this have a downside that more often than not have a mirror image of the upside… The timing [of when a correction comes] is a wildcard, but traders are indeed very wary of the downside of this spike,” said Shawn Church, editor at Fastmarkets Random Lengths.

As Fortune has previously reported, the first run was created by pandemic lockdowns that limited production just as remote working set off a home renovation boom and recession-induced low mortgage rates spurred more demand for homebuilding. (If you want a more detailed breakdown of last year’s lumber bubble, go here.) But the dynamics driving this latest run on lumber prices is very different.

“The latest pricing surge is far less due to a shortage of lumber production, but instead a crisis of shipping and logistics. The acute rail and trucking disruptions that currently plague the market were initially kicked off by the unprecedented flooding and mudslides in British Columbia in November, and then further exacerbated by the labor disruptions from Omicron and winter weather further bogging down critical rail lines from Canada to the U.S.,” Dustin Jalbert, a senior economist at Fastmarkets RISI, where he covers the lumber market, told Fortune.

Shipments are starting to increase again in British Columbia now that the mudslides and flooding caused by record rainfall in November are in the rearview mirror. However, there are still delays getting lumber shipments out of the Port of Vancouver.

“A number of mills in British Columbia have recently announced production curtailments, not because they are not making money, but they are running out of room to store finished inventory as production outpaces shipping throughput,” Jalbert said. “That disconnect between retailer and wholesaler needs, and what [they] can actually ship to market, is ultimately fueling buyer panic that is helping prices rally higher.”

Industry insiders say a price correction could come once warmer weather allows railcars in British Columbia—the epicenter of North American lumber—to run faster and more frequently. That will allow more supply to hit the market, and should reduce the panic buying by homebuilders and lumberyards alike.

“With last year’s price spike, the current amount of committed projects, and the ever expanding transportation delays, the path has been cleared to retest the record highs of 2021,” said Todd London, SVP of sales for Sherwood Lumber Corp. “After this seasonal push, things look ominous. Peak demand is behind us, and supply is steadily increasing.”