First I would like to emphasize that all data about oak prices from the past come out of Silvaapis’ historical prices on European market. It is possible that some of the readers have different experiences.

HISTORICAL OAK PRICES

I started producing fingerjointed oak panels in 2002 and glued by width oak panels in 2006. I wondered how the oak prices were rising in the past 20 years, so I started a small investigation. I went through my archives and wrote down the oak prices for panels through the past 15 years. The earlier archive is unfortunately already gone. We have to keep archives in Slovenia for max. period of 10 years.

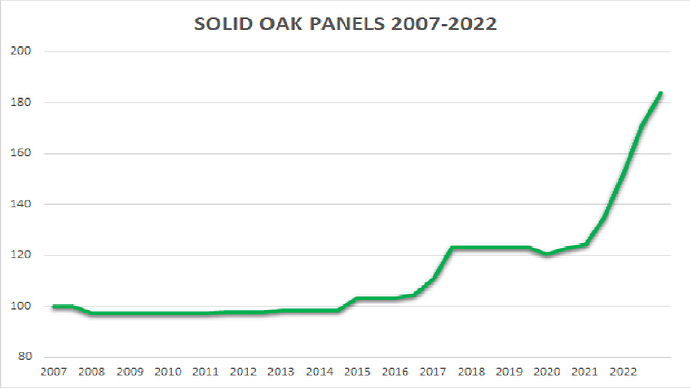

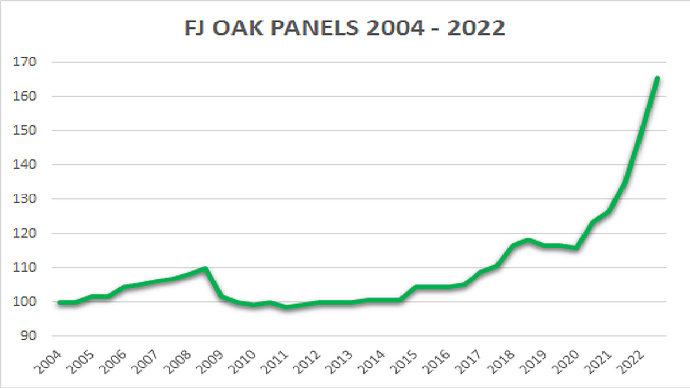

I made two simple Excel charts, which are presented below.

For easier understanding imagine that the starting price was 100 and the current price today is 180.

As you can see both charts do not vary a lot. A small fall in price in 2009, price stagnation until 2017, a 20% raise in price from 2016 to 2020 and explosion in second half of 2021.

As you can see the oak prices raised cca 20% until 2021. And we are talking a period of cca 15 years.

If we consider annual inflation at cca 2%, we can see that oak prices did not even catch the inflation rate. In other words – oak got significantly cheaper over the past 15 years.

In 2021 price explosion begun and oak gained another 60% in the following 9 months. We still don’t know where this will end, but it seems that the market is calming down.

However – we are talking about the most prestigious hardwood in Europe and the prices were so incredibly low only until a few months ago. No wonder that everyone wanted to have oak furniture, solid oak parquet and nice looking solid oak stairs. And practically everyone could also afford it.

I believe those days are over. I think oak is coming back to the pedestal of hardwood where it belongs.

If we compare oak wood to commercial softwoods we can see that oak has no big historical oscillations in price. Somehow the prices remain stabile and the market is robust. On the other hand the prices for softwood (especially pine and spruce) are very sensitive on the basic demand-supply economy and building seasons.

CURRENT SITUATION ON THE MARKET

Enough talking about the past. Let us try and see what is happening on the oak market and what triggers can move the oak prices either way. Available information show that the prices should stabilize before summer and that we are looking at a much calmer autumn.

Here are some important starting points:

- REDUCED OR EVEN BANNED EXPORTING OF OAK LOGS TO CHINA

Serbia finally decided to stop exporting logs to China. The main reason for temporarily 60 days banning is fear of lack of firewood for winter. Whatever the reason is, it is good that it happened and hopefully these 60 days will be extended to a much longer period, maybe even to eternal banning of log exporting.

If Serbia did it, then probably at least Serbian part of Bosnia will follow and maybe soon after the whole country of Bosnia and Herzegovina will do it, too.

- OAK SUBSTITUTES

The main substitute on hardwood market is currently ash and in minor quantities also ash and robinia. I am getting a lot of inquiries for ash lately and some of my major business partners are planning to increase their marketing strategies on ash and less on oak.

Anyway – we must be aware that the quantity of other hardwoods in the forests comparing to oak are much lower.

- LOWER SALES OF FURNITURE IN EUROPE

Due to coming threads of recession, high inflation and uncertainty due to war in Ukraine the sales of furniture in Scandinavia dropped for over 20%. I expect the same trend to happen all over Europe, which would lead to higher availability of raw oak material on the market.

- INFLATION AND HIGHER INTEREST RATES

Inflation is forcing central banks to start raising interest rates, which will probably result in lower investment activities and lower demand on wood. We can expect less building activity in 2023, so less new stairs, furniture, parquet flooring,….

- ENERGY CRISIS

Maybe the prices of hardwood reached the peak, but the main threat for the future months is the price of energy derivates. I can tell you that contracts for electricity for productions rose cca 60% from last year. As I write this we are getting already offers for electricity for 2023. Traders demand another 300% raise in price.

So the raise in price will be over 450% in 2 years. My question is very simple – WHY??? Our electricity comes mainly from nuclear powerplants, hydro-powerplants and thermal-powerplants. Is the water running slower, are the costs for uranium and coal 450% higher? I don’t think so. However the impact on industry will be huge. And we all know that wood industry uses a lot of electricity.

CONCLUSION

My expectations regarding hardwood prices are optimistic. I expect the prices for raw material will calm down and I believe we are seeing the peak of hardwood prices at the very moment. I don’t expect any significant price reductions, after all hardwood must have a certain value on the market, so expecting a huge decline in price is unreasonable.

What is worrying me is increasing prices for energy (electricity, fuel, gas) which can in short term cause price increasing of wooden products, even though the prices for raw material will not change.

The uncertainty of the incoming months is a fact. The brave ones will embrace it and come out as winners, the scared ones will…… probably survive, too.