Softwood fluff prices had a historic price run globally in 2022, before registering a steady decline from mid-2022 through the third quarter of 2023. The effective list price of fluff in Europe and North America dropped from a peak of $2,230 per tonne in July 2022 to $1,710 per tonne in September 2023. Similarly, the net price of fluff in China moved down from $1,370 per tonne in July 2022 to $830 per tonne in September 2023. Since then, prices picked up substantially in the fourth quarter of 2023 and the first quarter of this year. Effective list price for fluff in Europe and North America rose by $130 per tonne over four months to reach $1,840 per tonne in March. Chinese net fluff prices also gained $80 per tonne over October-December to reach $910 per tonne, but prices then dropped by $10 per tonne to $900 per tonne in February-March. Prices continue to face upward pressure, with developments in the paper-grade market supporting bleached softwood kraft (BSK) prices. This compels us to take a closer look at swing capacity for softwood fluff pulp and BSK.

Currently, there are around 10 pulp mills that have the ability to swing between producing BSK and softwood fluff; we estimate their combined capacity at around 4.1 million tonnes in 2023. Roughly 75% of this capacity is located in the US South, swinging between fluff and Southern bleached softwood kraft (SBSK), with the rest located in Europe and Latin America. Total global swing capacity has increased from around 3.5 million tonnes in 2016, growing around 22% to 4.1 million tonnes in 2023. Over this time, we estimate that the swing capacity dedicated to the production of softwood fluff has also increased from 72% in 2016 to nearly 90% in 2023.

The question is: What has driven this shift?

What is driving shifts in capacity?

The main factors supporting increased capacity swinging to fluff output are the prices for each grade and their costs of production. Supply and demand dynamics within the fluff and BSK markets also play a role. The price of fluff pulp has increased over time, and the pace of increase has been faster than that for BSK in the last few years. The net price of fluff in China averaged around $605 per tonne in 2016. This climbed to an average $1,253 per tonne in 2022 and declined to $973 per tonne in 2023, equivalent to a 61% increase over eight years. The effective list price for fluff in the North American and European markets have also trended higher, climbing from $1,010 per tonne in 2016 to a peak of $2,070 per tonne in 2022, then averaging $1,904 per tonne in 2023. The price in 2023 was nearly 89% higher than the 2016 average, although the discount rate has also increased over the same period.

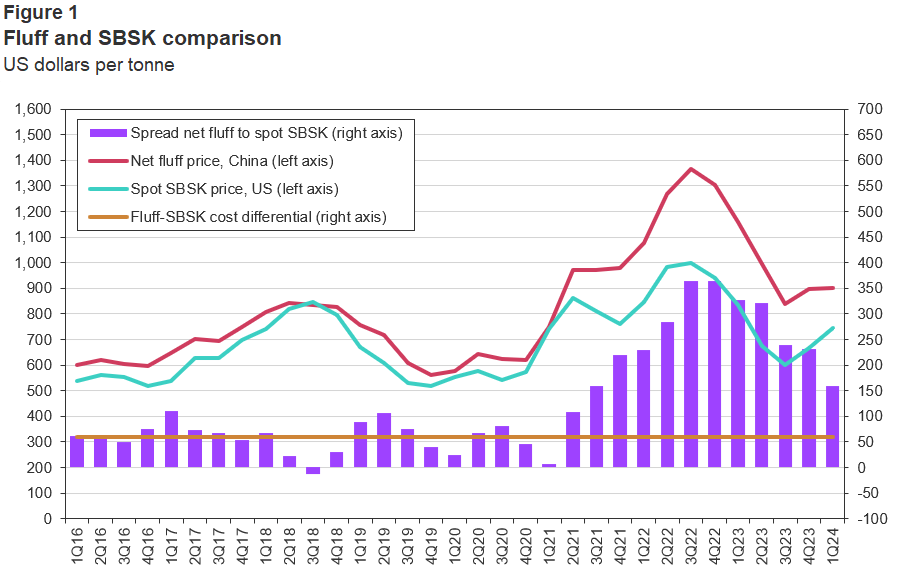

We can attempt to understand the decision to swing by looking at the spot market for SBSK in the United States. Because the spot market is not linked to long-term contracts, it can better capture market tightness and the potential for swing producers to find buyers for spot tonnage. The spot price of SBSK in the US also increased, rising to $694 per tonne in 2023 from $543 per tonne in 2016, with the peak annual average at $943 per tonne in 2022. SBSK spot prices increased only 28% over 2016-23. The spread between the net price of fluff in China and the spot price of SBSK in the US, which was at $62 per tonne in 2016, narrowed to $26 per tonne in 2018. The fluff-SBSK spread subsequently expanded and peaked at $310 per tonne in 2022 and was around $280 per tonne in 2023. In 2023, the net fluff price in China was 40% higher than the SBSK spot price in the US.

Production costs impact on swing

Another factor affecting swing is the cost differential between producing fluff and SBSK at swing mills. The average cost difference between producing bleached softwood fluff and SBSK was around $60 per tonne in 2023, compared with an average price difference between the two grades of $280 per tonne. This wide price spread compared with the cost difference should keep most swing mills in the fluff market, where they can generate greater profits. When the price gap falls below the cost difference, swing producers will likely move to BSK production.

In addition to price and cost considerations, demand and supply for fluff and BSK can also influence swing capacity decisions. Several mill closures last year tightened supply for BSK pulp. And in the first quarter of this year, AV Terrace Bay idled its operations indefinitely, taking 320,000 tonnes of BSK supply out of the market. Fluff pulp supply also registered capacity losses last year, with three mills in the US stopping operations in the fourth quarter of 2023, removing around 550,000 tonnes of supply from the market. This included a swing line at International Paper’s Riegelwood mill. The recent port strike in Finland between March 11 and April 8 caused Metsä Group and UPM to announce force majeure. While these companies have resumed operations, the recent explosion at the Metsä Kemi mill has disrupted supply further. This facility, which started in September 2023, is the largest NBSK mill in the world. It will now be down for around three months to conduct repairs, affecting its ramp-up. These events have tightened the BSK market considerably, pushing BSK prices higher.

The SBSK spot price in the US climbed by more than $170 per tonne between September and March, posting steeper increases in February and March. The list price of SBSK has also made strong gains in North America and Europe. Meanwhile, the net price for fluff in China increased by $80 per tonne in the fourth quarter of 2023 but declined $10 per tonne in February. Upward pressure in the paper grade market is having a ripple effect into fluff, and producers have announced fluff price hikes for April in the European and North American markets. Dramatic price hikes for fluff in the Chinese market in the future will be checked by the substitution of prime fluff with domestically produced fluff. Compared with China, the European and North American markets will be more open to price hikes.

The price and cost of production factors continue to favor fluff pulp for swing mills in the US South. But demand and tightness in the BSK market could encourage some swing producers to shift to BSK. The decision to swing between the grades also depends on contracted volumes at swing mills, where mills have to produce a particular grade to satisfy their customers. The economics of swing capacity, however, continued to be with fluff pulp in March, when the price gap between fluff and SBSK was greater than the cost difference.

Source: What motivates swing between Softwood fluff and SBSK?