July 27, 2022

Author: John Greene

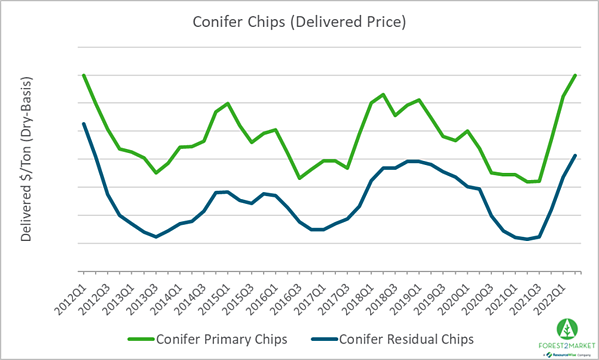

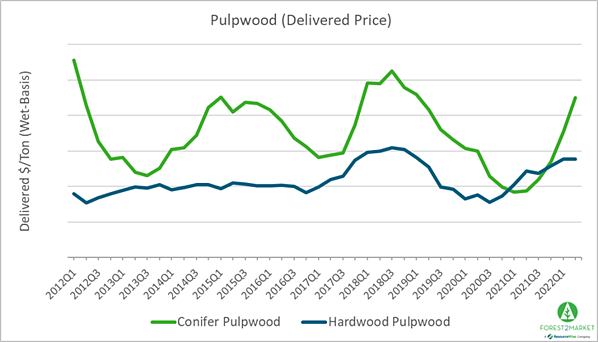

Demand for conifer wood chips and pulpwood softened in the Pacific Northwest (PNW) in response to the onset of the Covid-19 pandemic in early 2020. After initially dropping, prices reflected the widespread sense of extreme uncertainty for the next several quarters and hovered around the 10-year floor price. But prices reversed course sharply in 3Q2021 and have been climbing ever-higher since; conifer primary and residual chip prices are now at a 10-year high in the region.

The PNW is a unique market with unique drivers of supply and demand.

As basic economic theory commands, the equilibrium between supply and demand ultimately drives price and when one of these elements falls out of balance, price will respond accordingly. In the case of wood chips, the PNW is generally more sensitive to supply side drivers for two primary reasons:

-

Consumers of wood fiber have two options: chips and/or pulpwood (small-diameter logs), and most typically utilize some combination of the two based on price and availability. The PNW is largely a chip market unlike other regions such as the US South, which has lots of demand (and capacity) for both chips and pulpwood. This lack of pulpwood availability makes the PNW fiber market overly dependent on, and particularly sensitive to, chip supply.

-

Timber supplies in the PNW remain stressed due to lack of harvesting on federal lands, and the region continues to experience devastating effects from seasonal wildfires. Based on the current legislative environment, there is simply no opportunity for expansion; the regional market for public timber is virtually non-existent, and the supply of private timber is largely maxed out. Unless more public timber becomes available to the market in the near term, the forest industry—and the forest resources—in the PNW will remain limited, and fiber prices will reflect supply constraints.

Primary & Residual Chip Demand

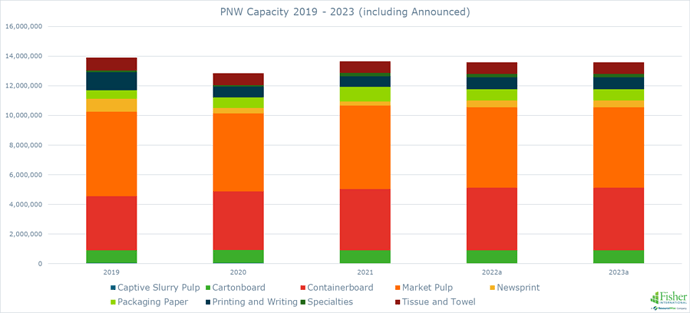

While lumber manufacturers ramped up production to take advantage of record prices for finished softwood lumber in in late 2020 and 2021, pulp and paper production in the PNW has largely remained flat.

This suggests unchanged chip demand from the P&P industry over the last couple of years and prices largely reflected this softness through 3Q2021. However, prices surged in 4Q2021 and they continue to trend higher as we enter 3Q2022. Delivered prices for conifer primary and residual chips are up 38% and 37% year-over-year (YoY), respectively.

Regional chip demand is so strong that the sharp price spike has also bled into the pulpwood market; prices for conifer pulpwood are now up 45% YoY.

What’s Driving the Price Reversal?

While P&P capacity in the PNW has been stagnant over the last few years, production and actual demand for wood fiber in the region has fluctuated. Consumption and delivered wood prices can vary significantly on a quarterly basis depending on short-term supply/demand balances, as well as other factors that include seasonality and skyrocketing inflationary pressures that impact the supply chain.

In early 2022, for example, a number of drivers moved delivered chip prices higher. Regional lumber production was down 4%, which impacted chip availability. Low wood fiber inventories and difficult weather conditions also stressed availability and contributed to higher prices.

There are a few supply- and demand-side market developments that have also coincided to cause the current price spike:

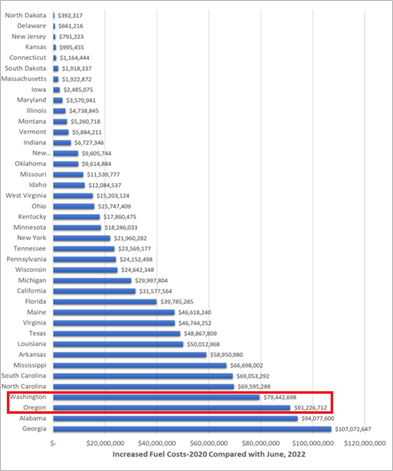

- Increasing fuel costs: Since mid-2020, the average price of pump diesel fuel has surged from $3.28/gallon to $5.72/gallon today. Per recent data from our friends at Forest Resources Association, “…the change in diesel fuel prices from 2020 to 2022 has resulted in an estimated average cost increase of $2.88 per green ton for delivered raw forest products. The total impact to the forest products sector is estimated at more than $1.2 billion in added fuel costs from 2020 to June 2022 to deliver raw forest products from in-woods operations to a manufacturing or energy facility.” Some of the largest impacts are being felt in the Washington and Oregon.

2.The estimated increase in cost to transport raw forest products from in-woods locations to mills due to the increase in diesel fuel prices from 2020 to June 2022 by state. The estimate is based on trucks averaging 6 miles per gallon and a roundtrip distance of 138 miles. Source: Forest Resources Assocation.*

-

Small log demand: While finished lumber prices have waned over the last three months, demand for small logs remains strong. If mills are still willing to accept small logs (down to 3-1/2" top diameter), it leaves little for topwood pulp availability on the market. Lumber mills are also accepting oversize culls, which have historically been rejected. While there isn’t much fire-salvaged timber left to profitably harvest, the transition back to harvesting green logs will improve prospects for small log availability, however, competition for these logs will remain.

-

Total fiber demand vs. inventory: Regional P&P production capacity may largely be flat, but overall fiber consumption – as well as fiber inventory levels – can significantly impact market demand and pricing. For instance, YTD consumption is down slightly (-2%) compared to 2021, but inventory levels are down roughly 25%, which is contributing to the upward price pressure on regional chips and pulpwood.

Outlook

All of these factors have combined to push chip prices significantly higher in the PNW. The limited log supply and extremely tight labor market have left regional mills in a difficult spot; most simply don’t have the capacity to increase production even if they wanted to. “Overwhelming instability” has come to define global commodity markets over the last 2.5 years, and this combination of events is poised keep upward price pressure on wood chips and pulpwood in the PNW for the foreseeable future.