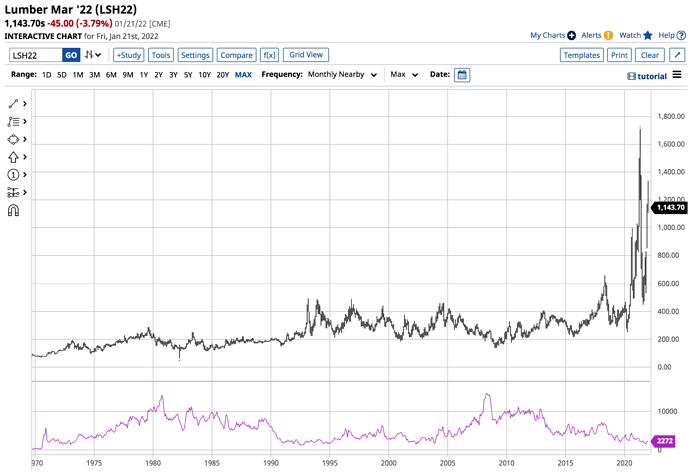

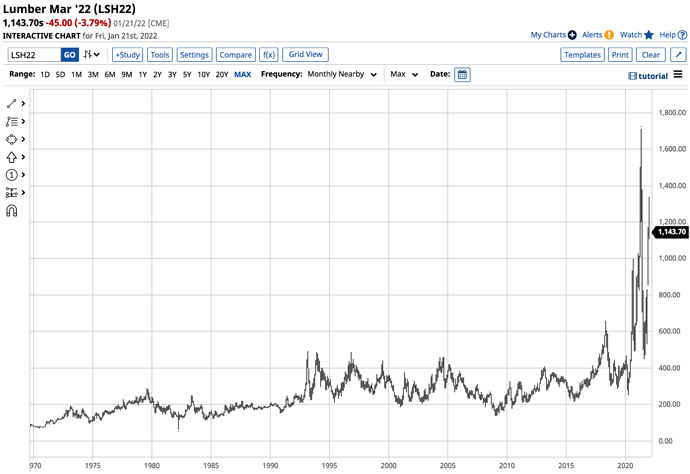

Before 2018, the all-time peak in the lumber futures market was at $493.50 per 1,000 board feet, the 1993 high. In January 2018, wood’s price eclipsed the 1993 high and rose to a new high of $659.

In 2020, lumber rose to an even higher high at $1,000 per 1,000 board feet, and in 2021, the price exploded, reaching $1711.20 in May. At the most recent all-time high, lumber traded at over three times the 1993 peak price.

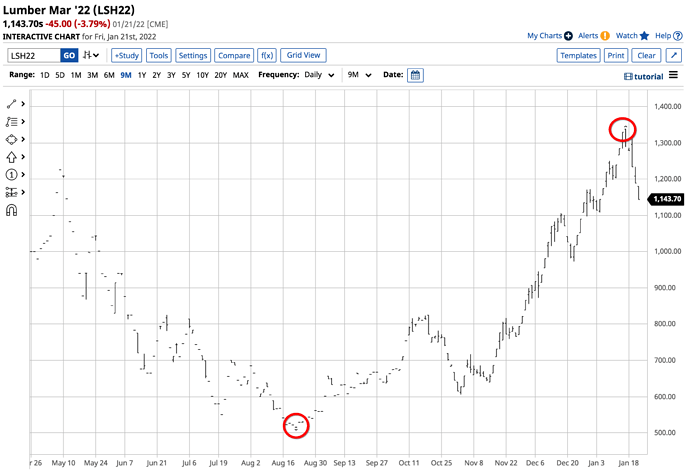

Last May, lumber ran out of upside steam at over the $1700 level, and the price explosion turned into an implosion, sending the price below the $500 level five months later in August 2021.

Lumber has been back in bullish mode since the August 2021 low, making higher lows and higher highs as it worked its way back over the $1,000 level. Rising inflation, the demand for new homes and infrastructure building, and supply chain bottlenecks have created an almost perfect bullish storm for the volatile lumber market. A new all-time high above the May 2021 peak is possible in 2022, and lumber could trade at the $2,000 per 1,000 board feet level, or even higher, over the coming months.

Lumber has more than doubled in price since the August 2021 low

The continuous lumber futures contract reached a low of $488 per 1,000 board feet in August 2021 as the price dropped to over one-third the level at the May 2021 $1711.20 high. The current active March contract reached a low of $515.50 on August 20, 2021.

The chart shows the explosive rally that took March lumber futures to the most recent high of $1338.20 per 1,000 board feet on January 14, a 159.6% gain since the August 2021 low.

The price was trading at over the $1140 level on January 21, as the lumber futures market pulled back over the past week.

Lumber futures market liquidity exacerbates price volatility

Open interest is the total number of open long and short positions in a futures market, and it is a critical indicator for a futures market.

The chart shows that open interest in the lumber market stood at the 2,272-contract level at the end of last week.

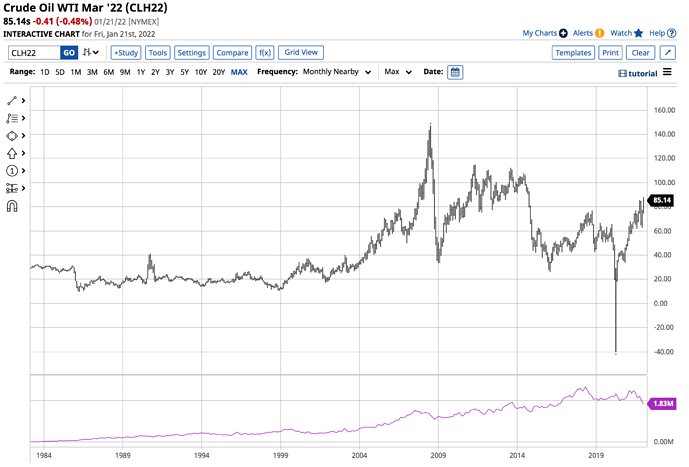

In NYMEX crude oil futures, open interest was over 1.8 million contracts.

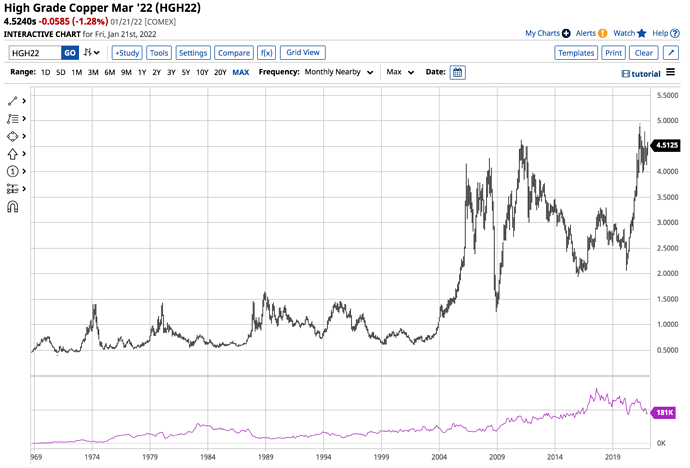

In COMEX copper futures, the metric stood at around the 181,000-contract level.

To say that lumber futures are illiquid would be an understatement. Low liquidity causes bids to disappear when prices fall and offers to evaporate as they rise. Illiquid markets tend to experience illogical, unreasonable, and irrational price action that exacerbates price movements during trends. Illiquidity can lead a market to rise to unthinkable levels on the upside and fall to the same on the downside. Lumber futures are the poster child for illiquidity in the futures arena.

The upside target sits at the 2021 high

Bull and bear markets rarely move in straight lines, and corrections can be swift and ugly. Meanwhile, on January 21, the trend in lumber futures remains bullish.

The long-term chart since the late 1960s shows the current technical target stands at the May 2021 $1711.20 high.

Higher highs are possible as the demand for lumber remains robust

Meanwhile, lumber’s lack of liquidity has the potential to push the price to a new high, and even to $2,000 per 1,000 board feet or higher in the current environment where inflation is raging, demand for new homes is booming, and US infrastructure rebuilding is pushing lumber requirements higher. Replacing plastic with paper products to protect the environment is also increasing the demand for wood. Moreover, pandemic-related supply chain bottlenecks continue to have the potential to cause supply disruptions.

Expect lots of volatility, and you will not be disappointed

Lumber’s position as a commodity that is the poster child for illiquidity also makes it the same for price volatility. Lumber has a habit of being a leading indicator for other commodity prices. Lumber’s rally to over $1300 per 1,000 board feet was a precursor for rallies in crude oil, copper, and many other commodities in early 2022. Last week, Brent and WTI crude oil futures rose to their highest prices since 2014, the last time the energy commodity traded above the $100 per barrel level. Copper was above the $4.50 per pound level, and even gold and silver prices have rallied over the past week.

Lumber is a leading indicator for the commodities asset class. Watch the lumber price as it could signal the path of least resistance for raw material prices over the coming weeks and months.